Over time, commercial transactions are constantly evolving due to digitalization and globalization of markets. Recent global events, such as the COVID-19 pandemic, further accelerated the transformation from the traditional work model into today's digital workplace. In this same way, governments are constantly adapting their tax rules to further regulate this new business environment according to the new market trends and needs.

For example, the South Dakota v. Wayfair case (138 S. Ct. 2080), demonstrates how governments are adapting to technological advances while they continue collecting revenues digitally.

This article provides a brief overview of the tax implications of the 2018 Wayfair ruling for Puerto Rican taxpayers, and how this case impacted the Puerto Rico Sales and Use Tax (PR SUT) since its issuance.

South Dakota v. Wayfair

On June 21st, 2018, the Supreme Court of the United States reviewed the case of South Dakota vs. Wayfair and decided to overturn the rule previously established in 1992 based on the arguments presented by the parties. Prior to this case, physical presence was the main factor in establishing nexus in a state and thus implementing the collection of sales tax (See Quill Corp. v North Dakota). The decision ended 5-4 in favor of the state of South Dakota and eliminated the requirement of physical presence in a state to create a nexus. The court decided that taxpayers establishing economic presence in a state could be enough to create a nexus and will be required to collect and remit State and Local Sales Tax for a tax jurisdiction, as long as the approved law does not impose an undue burden on interstate commerce.

Furthermore, the South Dakota Law established thresholds in the number of transactions with residents of the State and limits in the gross revenues from sales made to the jurisdiction to create an economic nexus. According to the South Dakota Law, those merchants who reach 200 transactions with its residents or generate $100,000 in sales per year create an economic nexus with the state and must register, collect and remit the South Dakota sales tax.

This decision was well received by most states since it opened the door to be able to approve laws that are more adapted to the current commercial reality. After the court's decision, most states approved laws to implement economic nexus standards similar to the South Dakota court's decision. With these new laws, the states will be able to generate additional revenues by imposing sales tax on e-commerce transactions and mail order sales.

Changes in the PR SUT since the court decision

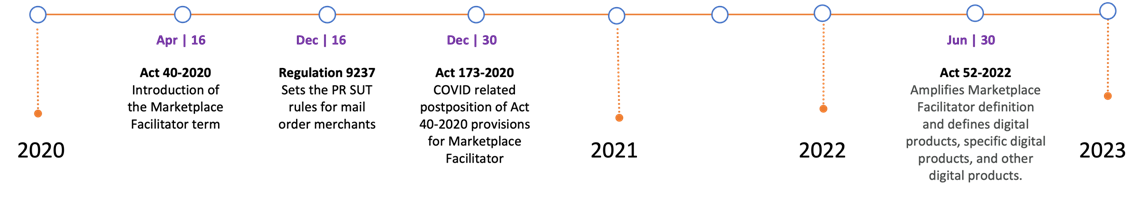

Five years after the Supreme Court ruling in South Dakota v. Wayfair, the government of Puerto Rico incorporated changes to its tax system following this landmark decision. The following presents a timeline of some of the measures approved by the government of Puerto Rico since this case and a summary of their provisions.

• Act 40 of 2020

• Act 40 of 2020

In relation to the e-commerce and mail order sales, Act 40 of April 16, 2020, incorporated the term "Marketplace Facilitator" and established the requirement of collecting the sales and use tax on sales made through these marketplace facilitators retroactively to January 1, 2020. In addition, this law added the term "Marketplace Seller". It established the requirement for Marketplace Facilitators to collect and remit the sales and use tax in representation of the Marketplace Sellers for those sales of goods or services made through their marketplace.

• Regulation 9237 issued on December 2020

In this Regulation, the Puerto Rico Treasury Department established the rules for taxpayers engaged in mail order sales to be considered a Merchant for purposes of the PR SUT (Merchant). Like the state of South Dakota, a taxpayer will be considered a Merchant in Puerto Rico if its gross revenue on mail order sales delivered to Puerto Rico customers exceeds $100,000 or carries out at least 200 transactions during its accounting year. Those engaged in mail order sales which are considered Merchants for meeting the transaction volume or revenue thresholds, are required to register with the Puerto Rico Treasury Department, collect the PR SUT, file monthly PR SUT returns, and remit the tax on a monthly basis.

Before the above change and since 2017 (Act 25-2017), a business that did not have a physical presence on the Island was required to provide information on the consumers to whom they sell and file quarterly and annual reports regarding their sales to customers in Puerto Rico. Due to this requirement, many companies, including the major online retailers, established voluntary agreements with the Puerto Rico Treasury Department to become withholding agents and started collecting the sales and use tax, filing the monthly returns, and depositing the tax.

• Act 173-2020

Act 173 of December 31, 2020, postponed the effectiveness of the dispositions related to Marketplace Facilitators established in Act 40-2020 because it was signed when the Covid-19 pandemic had already begun. This Act postponed the dispositions for transactions made after December 31, 2020. Therefore, the Marketplace Facilitators were required to collect and remit the PR SUT starting January 2021.

• Act 52 of 2022

Act 52 of June 30, 2022, amended the definition of "Marketplace Facilitator" to include people dedicated to the sale of admission rights on behalf of a Marketplace Seller when they comply with the requirements of the definition. Prior to this amendment, the admission rights were not included within the taxable items sold by a Marketplace Facilitator and for which they must collect the PR SUT on behalf of the Marketplace Sellers. This amendment applied to the online platforms dedicated to selling admission rights.

In addition, Act 52-2022 amended the definition of "Marketplace Seller" to include those dedicated to the sale of admission rights, taxable services, or the sale of specific digital products through a physical or electronic marketplace.

Act 52-2022 also added three important definitions to the Code: digital products, specific digital products, and other digital products. Before this amendment, these terms were mentioned in the Puerto Rico Internal Revenue Code (the Code) but not explicitly defined.

a. Digital products - Includes items that can be purchased through a digital transmission (streaming) either by purchase or subscription; video, photographs, applications for electronic equipment, games, music, computer programs, or any other item of a similar nature that is delivered to the buyer electronically or by digital transfer; specific digital products and other digital products.

b. Specific digital products - Means digital audiovisual products transferred or delivered electronically, digital audio products, or other digital products, provided that a digital code grants a buyer the right to obtain the product shall be treated in the same way as a specific digital product, including digital products in the format or medium of non-fungible token or "NFT."

c. Other digital products - Includes, but is not limited to, the following: greeting cards, images, games or video or electronic entertainment, memberships to electronic groups to obtain exclusive electronic or audiovisual data, including, but not limited to theatrical products, musical products, including concerts or videos, audiovisual material of adult content, news or information products, digital storage products, computer software applications and any other product that could be considered a digital product, whether electronically or digitally delivered, transmitted or accessed.

Evidently, the Covid-19 pandemic changed the business environment and electronic transactions increased exponentially. However, the Puerto Rico Treasury Department not only adapted its rules to the Wayfair case, but through a series of amendments to the Code, the government of Puerto Rico expanded its sales and use tax collection capabilities in areas where the Law and Regulations didn't provide enough guidance as to the need of collecting the sales and use tax. Puerto Rico was one of the first jurisdictions to establish rules for imposing tax on digital products such as the NFTs, and it is expected to have additional changes to adapt the system to this fast-changing digital commerce environment.

After five years of the South Dakota vs. Wayfair decision, the collection and remittance requirements of sales tax for remote sellers and Marketplace Facilitators have been adopted by almost all states. The U.S. Supreme Court’s decision has changed more than a decade of precedents related to sales and use tax, and its effects will likely continue to develop for decades to come.

We are committed to keeping you informed of all the latest developments in laws and regulations that affect businesses in Puerto Rico. We can help you navigate the complex tax landscape to ensure that you are taking advantage of all the available benefits. Contact us today to learn more about how we can help you.