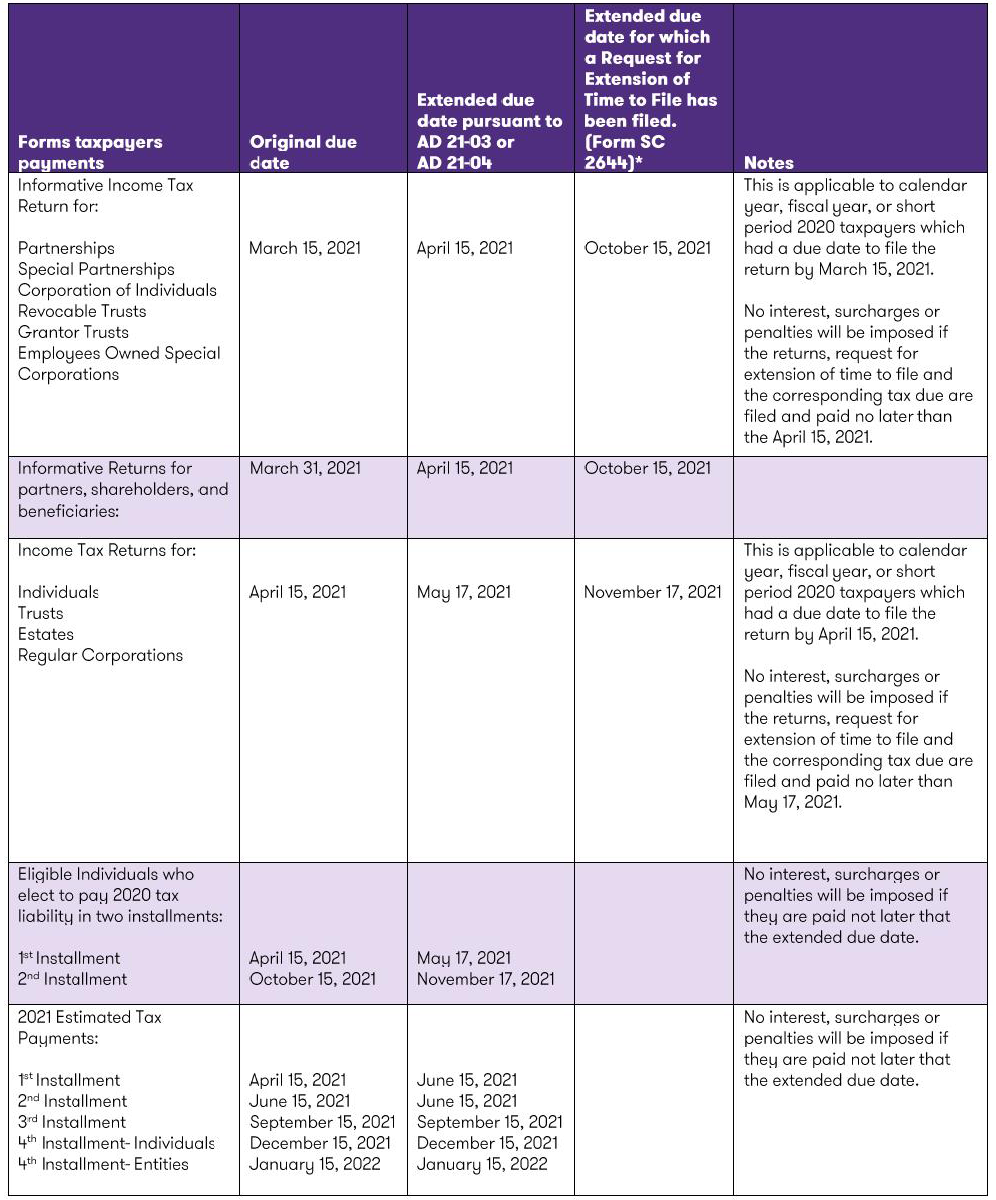

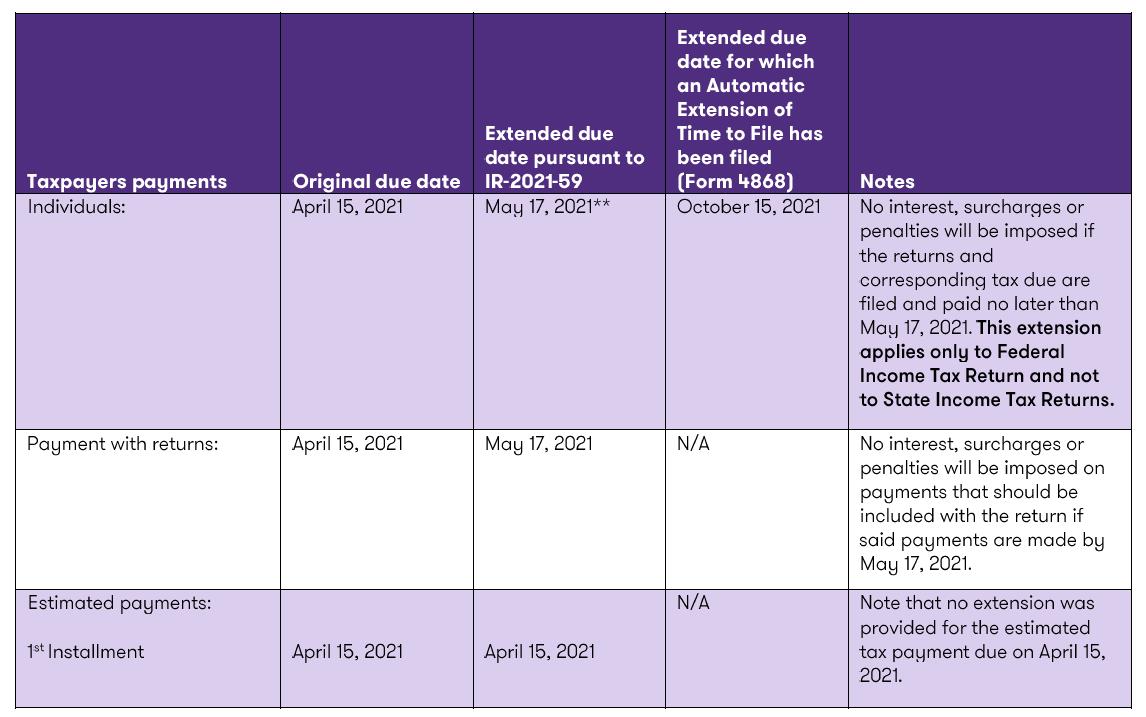

To relieve taxpayers from the burden regarding the fulfillment of their tax responsibilities while the Puerto Rico Treasury Department Secretary (Secretary) deals with the improvement and programming of its principal platform, SURI, they have issued Administrative Determinations 21-03 (AD 21-03) and 21-04 (AD 21-04) to inform the new due dates for the filing of certain returns, filing extension requests, declarations, and forms. Likewise, the Internal Revenue Service issued Publication IR-2021-59 extending the US Tax Day for certain taxpayers. Administrative Determinations 21-03 and 21-04, and Publication IR-2021-59 provide the following revised due dates:

Puerto Rico tax deadlines

*On March 17, 2021, the Puerto Rico Treasury issued Circular Letter 21-09 establishing that for 2020 Tax Year every taxpayer that needs to request an extension to file, must do it by electronic means via SURI, regardless of whether the corresponding tax return is paper filed.

Internal Revenue Service

**Winter storm disaster relief for Louisiana, Oklahoma, and Texas- IRS announced that individuals and businesses located in these states that have until June 15, 2021 to file their tax returns and make tax payments. This extension to May 17 does not affect the June deadline.

Management and Budget Office (OGP) issued the Circular Letter 008-2021 to notify that the due date for the Volume of Busines Declaration (Declaration) for the fiscal year 2021-2022 will be May 24, 2021, considering the extended due date provided by the Secretary. The taxpayer may request an extension of time to file the Declaration on or before May 24, 2021. The extension request is automatically approved and may be provided for a maximum six-month period until November 24, 2021. Notwithstanding the extension concession, the Finance Director may revoke it or provide a period of less than six months to file the Declaration.

The taxpayer may pay the tax due by May 24, 2021 with a five percent (5%) discount or in two equal installments, without discount, due on July 15, 2021 and January 15, 2022.

Sharrilyn Sánchez, CPA

Tax Director

Rodolfo Rosario

Tax Semi Senior

Collaborated in the preparation of this article.

We are committed to keeping you up to date with all tax-related developments. Please contact our Tax Department should additional information be required regarding this or any other tax issue. We will be glad to assist you.