By Diane Swonk, Chief Economist

Each year, I share a week with more than 25 economists representing nearly as many countries to debate the state of the global economy. The group started meeting in 1937, trying to disentangle the economic malaise of the Great Depression. Back then, women were not welcome in the elite ranks, which were dominated by luminaries from Europe. We had to take a break during World War II.

When the pandemic hit, we had to cancel our meetings scheduled for Madrid, June 8-12, but kept in touch as COVID-19 made its way to our respective shores. The first of our group to be affected was a colleague in Hong Kong, a country that decided early on not to trust the Chinese government, to wear masks and adopt testing and tracing techniques to isolate and stem the spread of the virus. People in Hong Kong remembered the SARS outbreak in 2003 and moved proactively in January.

The mitigation efforts worked. Only five people died of COVID-19 in Hong Kong, a city even more densely populated than New York. The death count in New York City has passed 22,000 and is still rising but more slowly than it was when the pace of infections was higher.

Our group decided that the whole is greater than the sum of its parts when attempting to analyze COVID-19. We moved our conference online and worked around the clock to connect across time zones. The meetings are guided by Chatham House rules, which means that I can’t quote anyone directly but I can share what I learned.

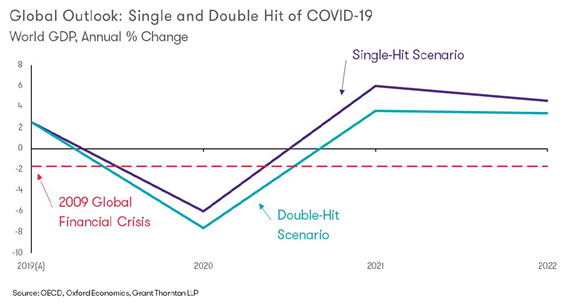

The week was sobering. The consensus among the group is for a 4%-5% contraction in the global economy in 2020, the worst since the Great Depression. Risks to the downside are mounting.

The U.S. ranked with the U.K. and Brazil as countries that have handled the health crisis the worst. South Korea, Taiwan and Hong Kong were seen as models for the rest of the world. More than 60% of our members believed the lockdowns were worth the cost given the threat to health and the broader economy. A significant minority - more than 30% - felt the lockdowns went too far.

My colleagues abroad were mystified by the resistance to wearing masks in the U.S. They were even more befuddled by the large number of people who said they would not get a vaccine when available.

The Center for Disease Control and Prevention (CDC) clearly muddled the initial messaging on masks, saying they were no panacea. They were trying to preserve inventories of critical personal protective equipment (PPE) including N95 masks for first responders, which were suffering severe shortages.

There is also a racial divide that is more prevalent in the U.S. than elsewhere. My Black friends openly worry about being profiled for wearing a mask in a store; their courage in wearing masks to protect their community has been humbling. Many also understate the risk of contracting COVID - the young are especially bad.

None of those explanations can begin to explain why the U.S. is still such an outlier on masks. The research is unambiguous. A global review of the effectiveness of masks showed that wearing any kind of mask reduced the pace of infection from 17% to 3%. That is an 80% reduction in transmission, just by covering faces in public places. Yet we still have a poor uptake on mask usage. That leaves politics. My colleagues were shocked that many state and local governments refused to require masks in public places, especially where social distancing is difficult. The fear is political backlash, which remains substantial. Some see masks as government overreach.

This special edition of Economic Currents provides a roundup of how the world is likely to emerge from this COVID recession by region. Gains will be extremely uneven, with manufacturing based and closed economies doing better than service sector and commodity driven economies. I wouldn’t want to be an island country dependent on tourism at the moment.

Emerging markets are in a precarious position with herd immunity rapidly becoming the only strategy. China and the U.S., the two largest economies, are the biggest wild cards in the outlook.

Chart 1

![Global outlook single and double hit Covid-19]()

China’s aggression on the global stage is widely expected to intensify, while recurring regional outbreaks in the U.S. and fiscal fatigue threaten to undermine the rebound over the summer. The strength of the economy is contingent upon our ability to effectively manage COVID and provide a backstop for the economic losses that are mounting in its wake.

Special attention will be paid to the shadow that COVID casts on the global economy. A recurring theme was that what was once unconventional or taboo when it comes to monetary policy is now conventional: Large-scale asset purchases by central banks are here to stay. That said, our group was divided on whether the push by central banks further into unconventional policies will compromise their independence.

The world that emerges from COVID will be more indebted, susceptible to deflation, prone to trade wars and fragmented than the world we left behind. The White House is mulling how to further weaponize tariffs to get more concessions from China and Europe, while the U.K. looks like it is edging ever closer to a hard Brexit. These developments will further concentrate economies in the hands of a few firms and undermine innovation.

There was surprisingly little concern in our group about the increase in sovereign debt across the developed world. That marks a sharp turnaround from the push for austerity we saw in the wake of the global financial crisis. There was also concern about the sharp rise in household and corporate debt in the developed world. Bank balance sheets are likely to pay the price of a surge in bankruptcies down the road. This is a concern that the Federal Reserve has flagged as well. What looks good today on bank balance sheets could deteriorate rapidly. The majority of our members believe more will be needed in terms of fiscal relief to blunt the blow of COVID.

The only possible silver lining to COVID and recent tragedies would be if they act as a catalyst for reforms that allow for more equitable growth. Racism and systemic bias not only hurt those they target; they take a toll on economic growth by protecting underperforming workers from competing with a larger talent pool.

A Global Roundup

Chart 1 lays out our forecast for global growth. We are more pessimistic than our peers. Our forecast shows the global economy will contract by almost 6% in 2020.

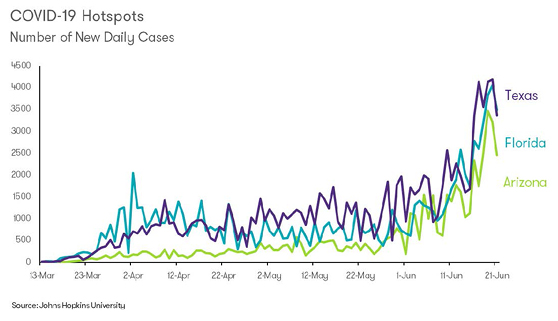

Chart 2

![COVID-19 hotspots]()

That is more than three times the contraction we saw during the global financial market crisis in 2008-09. Losses will be even larger if we can’t better manage the pace of COVID infections in the U.S. before a second wave arrives with the onset of flu season. Fear of a second wave alone is taking a toll as many businesses hold back on travel and conferences in the fourth quarter and major universities plan to send students off campus by Thanksgiving. The primary reason for our pessimism relative to the consensus is a weaker rebound in both the U.S. and China.

North America

U.S.

The U.S. was hit hard by the COVID crisis, with growth contracting at the fastest pace since the Great Depression during the first half of the year. Many grew optimistic about the pace of the recovery, given an upside surprise in the May employment report. Pent-up demand and faster-than-recommended reopenings across states provided a lifeline to retail sales but those gains came at a price.

States that reopened before critical benchmarks were met experienced a surge in infections and hospitalizations. A small portion of the increase in cases could be due to increased testing but hospitalizations are also rising, which are better indicators of infections than positive tests alone. (See Chart 2.)

The resurgence has already triggered store closings by Apple in the worst affected states. More retailers and service providers are likely to follow. Sports teams that had started to practice in Florida were forced to quarantine after a jump in COVID infections, while cruise lines announced they will not dock in U.S. ports for fear of infection. New York is weighing whether to quarantine travelers from other states.

All of that, coupled with more conservative behavior by older, more vulnerable parts of the population, is expected to undermine the rebound in growth over the summer. Infection rates are now hitting younger, less risk-averse parts of the population harder, as they are more apt to understate the risks of getting COVID. The rise in infections among children is a particular hurdle to reopening primary schools and allowing parents to get back to work.

This is at the same time that the clock is ticking on extended unemployment benefits, which expire on July 31, and what we expect to be draconian cuts to state and local budgets. Former Council of Economic Advisers (CEA) Chair Jason Furman testified to Congress last week that the pending collapse in unemployment benefits could shave 2.5% from overall growth in the second half of the year alone. That is equivalent to the annual growth the U.S economy generated before COVID. The blow to employment from cuts at the state and local levels is already hitting. Education has been worst affected. Next up will be basic services and first responders unless members of Congress get their act together on transfers to the states.

Any way we cut the data, the U.S. economy will be operating at a fraction of its previous peak. Real GDP is forecast to drop a stunning 7.9% in 2020. Efforts to hasten reopening before guidelines recommended by the CDC have virtually guaranteed a slower recovery as infections are picking up again - that acts as its own tax on economic activity. People have routinely shown their willingness to stay away from public places once infection rates spike.

Bankruptcies and the state of bank balance sheets are additional concerns. States are recalling retired bankruptcy judges to handle what may be a pending surge in the second half of the year and into 2021.

Canada

Canada is expected to be worse affected than the U.S. in 2020 as it works through a trifecta of blows from COVID. Air travel, immigration and oil prices all hit Canada very hard. The government and central bank have stepped up but the interventions are not expected to prevent a rapid downdraft in home prices. Immigration from China has for years played a major role in supporting the broader economy and real estate.

Canada has been more aggressive in bending the curve on infections, although it varies by province. Canadians have also been better about testing, tracking and tracing and are reopening more methodically than we are in the U.S. Canadians returning from abroad must adhere to a strict 14-day quarantine. The fine for violating quarantine is C$750,000. This means the reopening will be slow but more steady than in the U.S. A surge in COVID cases in Mexico represents another obstacle that could further disrupt production across North America. Parts in the vehicle industry cross borders multiple times before they become a vehicle.

Europe

U.K.

High-frequency data on the U.K. show signs of a nascent rebound as lockdowns are slowly lifted. Fiscal policy and monetary policy are blunting the blow of COVID. The government surprised many with its efforts to cover the bulk of wages lost due to COVID. The Bank of England has stepped up with large-scale asset purchases but has not had to do as much as anticipated. The announcement effect of asset purchases has proven to be large; if financial markets trust a central bank to follow through on its promises, less intervention is needed.

The gains won’t be enough to stem a more severe recession in the U.K.; it was late to lockdown and is paying the price with a slower reopening. A hard Brexit is a foregone conclusion, which will stunt recovery in 2021. The U.S. has also held back on negotiating a new trade agreement, which will further complicate matters.

“Racism and systemic bias… take a toll on economic growth by protecting underperforming workers from competing with a larger talent pool.”

Separately, the U.K. has joined the ranks of countries moving to further restrict foreign takeovers in the wake of COVID. The change is in addition to interventions the government approved for takeovers in the defense and tech sectors and include artificial intelligence, authentication technology - identity confirmation apps - and advanced materials. The legislation was specifically designed to prevent a takeover of a U.K. company doing vaccine research, but when combined with previous laws, will further restrict trade and access to the U.K. economy. There is substantial concern about where the first vaccine will be developed. Rationing is inevitable.

Eurozone

The Eurozone has begun to come out of severe lockdowns. We have seen some efforts to coordinate fiscal stimulus via the European Commission and the European Central Bank but aid continues to vary greatly by country. Germany is simply much wealthier and better prepared to backstop economic losses than its Southern counterparts.

The European Commission is mulling 750 billion euros in additional aid. Negotiations are expected to take place in Brussels where the European Commission will meet in person for the first time since February. There are still a lot of sticking points, not the least of which is the amount of aid and who will ultimately pay the tab. That said, Europe has more to gain than lose by coordinating fiscal relief.

Manufacturing based economies, including Germany, are better positioned to pick up than service and tourism-dependent economies such as France. The blow to Paris from the loss in Chinese tourism has been particularly acute. Germany can afford more stimulus than its counterparts and has moved much more aggressively to backstop business losses than the U.S.

COVID remains the biggest downside risk. Infections in Germany picked up again, which has triggered another round of targeted lockdowns. The most recent outbreak was tied to a meat processing plant. Sound familiar? Germany is leveraging a nationalized system of testing, tracking and tracing to isolate those who either are or likely to become infected. France is also struggling with localized outbreaks. My friends in Paris say masks were not worn by the majority of the people they saw at an outdoor music festival. There are challenges to reopening under the best conditions, let alone when basic rules such as wearing masks and thresholds to reopen are not met, as we are seeing in the U.S.

Trade tensions between the U.S. and the European union (E.U.) have flared. The White House is once again threatening tariffs in response to efforts by Europeans to tax U.S. technology behemoths. This is at the same time that Europe has moved aggressively to limit foreign direct investment in what it considers strategically important industries including, but not limited to, health care. The bloc wants to encourage more regionalized supply chains to limit disruptions from Asia. The irony is that manufacturing across Europe was crippled along with Asia. Production that is dependent on local or regional suppliers turned out to be as much at risk as that which is dependent on overseas suppliers.

Nordic Countries

The Nordic countries Denmark, Finland, Iceland and Norway fared better than their Southern counterparts with a much smaller incidence of infection and more flexibility to reopen. They approved more fiscal relief and stimulus than many of their counterparts in the Eurozone and are poised to do even more. Their central banks also stepped up, engaging in asset purchases to ensure access to credit markets.

The exception is Sweden, which decided to target herd immunity instead of lockdown, which has taken a fairly large toll on the economy; the effects are likely to be long lasting. The country is nowhere near achieving herd immunity, while the recovery in consumer spending has been much slower than in other Nordic countries despite aggressive fiscal aid. Many expect the Riksbank, Sweden’s central bank, to take interest rates back into negative territory. The consensus in our group is that negative rates create more problems than solutions, a view that the Federal Reserve has also adopted.

Central and Eastern Europe

The blow to Central Europe - Poland, Hungary, Romania, Slovakia and the Czech Republic - was abrupt but the pace of infections was better contained than in much of Europe. Early and aggressive lockdowns, including closing borders, helped limit the number of cases. Less open economies - Poland and Romania - fared better than more open economies such as Hungary. That reinforced the nationalism in Hungary. President Viktor Orban temporarily suspended parliament and all elections with an emergency decree, which he has partially reversed, in response to pressure from the U.S. and the E.U.

Most of the region is rebounding in line with Germany, with the exception of Romania, which is opening slowly. Aggressive fiscal and monetary policy will aid the rebound. This contrasts with other crises when monetary policy was constrained because of exchange rate moves.

The Federal Reserve easing has been a game changer for central banks in developing economies. By alleviating the upward pressure that we usually see on the dollar and downward pressure on the currencies of emerging market economies, it has freed central banks in emerging markets to stimulate instead of defending their currencies. That means rate cuts and large-scale asset purchases instead of rate hikes across emerging markets this time around.

Central European countries are seen by our group as the main beneficiaries of deglobalization and the push to regionalize supply chains in Europe. Perhaps this carrot is one of the reasons Orban backed down after the backlash to his emergency power grab in March.

Much of Eastern Europe has been hit even harder by COVID than Central Europe. Many nations have reached out for help from the IMF, which is doing what it can with what are now dwindling resources. Ukraine remains especially weak.

Asia Pacific

Japan

Japan was initially hit hard by shutdowns in China and the blow to tourism and trade. China is one of Japan’s largest trading partners. COVID marked a secondary blow to domestic demand.

Japan did not endure the strict lockdowns we saw in other countries but Prime Minister Shinzo Abe declared a state of emergency. The goal was to restrict public gatherings and encourage social distancing. Many businesses complied with the restrictions even though there was no enforcement. Japan pursued a strategy of identifying clusters of infections, which were usually tied to large public gatherings, gyms or crowded restaurants and bars. No clusters were tied to mass transit. Masks work.

The state of emergency lasted about six weeks, which further limited damage. Public opinion of Abe was initially negative but has since recovered. The success Japan had with shorter lockdowns and quarantines appears to have worked, while the Abe government has doubled down on efforts to provide Japan with the largest COVID aid and stimulus package in the world. It could top 40% of GDP. Our colleagues remain optimistic that the 2021 Olympics will take place in Japan next Summer. Japan was forced to cancel the Olympics as the virus spread in Spring 2020.

My colleagues and I noted that corporate balance sheets are in much better shape. This could be a structural advantage that Japan now holds relative to its more indebted peers in the U.S. and Europe.

The largest single risk is an extreme external event tied to weather or an earthquake. There is growing concern that Mount Fuji is due for an eruption. The widespread devastation from such an event was hard to listen to, let alone discuss. Nature can be humbling.

China

China, the epicenter of the crisis, has been surprising to the upside as manufacturing capacity comes back on line. Travel and retail spending have come back from the depths of the crisis. Uncertainty surrounding the outlook for China remains high enough that the government opted to forgo a growth target this year for the first time since the 1970s.

The problem is that COVID is still around and highly contagious. The Chinese government moved quickly to squash an outbreak in Beijing with targeted lockdowns. That and a lack of trust in the Chinese government could dampen spending and mute the recovery. China is expected to grow only 2% in 2020, or one third of the pace in 2019. Some worry China could contract in 2020.

“There is substantial concern about where the first vaccine will be developed. Rationing is inevitable.”

Separately, China has been unable to meet the already aggressive timeline on purchases for the Phase One trade deal with the U.S. This could trigger more tariffs ahead of November elections. Anger at China is bipartisan but additional tariffs would undermine our rebound.

There appears to be nothing in the way of China’s humanitarian infractions on its Muslim Uighur population, who it has rounded up and housed in concentration camps. Congress passed sanctions but it is unclear how those could actually be enforced.

A common worry is that China is filling the void left by the U.S. on the global stage. This includes a broad spectrum of actions designed to enhance President Xi Jinping’s power in and outside of China. It has turned its aggression on nearby Hong Kong; Taiwan could be next.

South Korea

South Korea was hit hard by COVID and the shutdown in China. Aggressive testing, tracking and tracing enabled more targeted shutdowns and helped contain the spread of the virus. That enabled a more robust rebound in domestic demand.

The largest remaining hurdle is external demand, which remained weak into May as lockdowns spread around the world. Manufacturers rapidly reopened but to a much weaker global economy.

There is also a threat that China could suffer additional lockdowns, which would undermine exports. The Chinese consumer has become a big buyer of Korean goods. The only silver lining is that supply chain disruptions are likely to be much less widespread than during the crisis. Manufacturers, with the exception of meat processors, have proven safer than service providers when it comes to the spread of the virus.

Developing Asia

The rest of developing Asia is a mixed bag. Singapore was seen as an early success story in its ability to contain infections. It quickly squelched an outbreak in immigrant camps and is launching a huge effort to stimulate. That will help the island nation come back much faster than many of its counterparts in the region.

The fates of Indonesia and the Philippines look much worse. They have been unable to contain the spread of the virus and are left with very few options; they don’t have the resources to offset lockdowns with stimulus. In many ways, COVID has turned the world on its side. Many of the unemployed in these economies were previously able to start small, street businesses. That acted as an automatic stabilizer when the economy tanked but is now off the table with COVID.

India is among those suffering disproportionately. The negative outlook has been further compounded by China’s aggression along its border with India.

Australia and New Zealand

I would be remiss without at least a brief mention of Australia and New Zealand, both of which have effectively wrestled the virus to its knees. The two are looking to create a travel zone between the two countries to boost tourism, which is important to both economies. Our friends in Australia talk of dining out without fear and mobility we once took for granted. The greatest threat is from citizens returning home from hot zones. Both countries have increased their restrictions on incoming travelers. (I am not holding my breath on their letting American citizens in any time soon.)

The problem for both countries is that they rely heavily on commodity exports to China. They are coming back but are still weak. Much of Australia’s near 30-year expansion can be traced to its ties with China and its emergence on the global stage.

Personally, I am hoping that New Zealand and Australia are able to start moving forward on content for streamed series and movies. Hollywood could take a while; I am running out of shows to binge watch.

Latin America

Brazil

Latin America has become the new hotspot for COVID; Brazil is leading the way with its president who has called the virus a “measly little cold,” fired two health ministers for their efforts to contain the spread and is now attempting to conceal data on deaths due to COVID. The country has leveraged both fiscal and monetary policy to blunt the blow from the virus. Those can’t begin to offset the losses triggered by the herd immunity strategy.

Going forward, political risk will likely overshadow economic risk. President Jair Bolsonaro has moved to consolidate power among the far-right and his most corrupt political allies. He is rewarding their loyalty with a level of cronyism that will further undermine any progress Brazil has made toward reform and fiscal sustainability.

Mexico

Mexico is another hot spot. It has even less fiscal and monetary policy space to offset COVID losses. Backpedaling on market reforms, notably in the oil sector, had taken a toll on business confidence and investment pre-COVID. Trade wars also proved costly as production in Mexico was hit by losses in U.S. manufacturing.

Mexico recently suffered a downgrade to its credit rating, which will further up the cost of any future fiscal stimulus. Hopes that Mexico would win as production moved back to North America from China have been dashed. The push to shorten supply chains will be more focused on parts that cross domestic instead of international borders.

Chile

Chile is expected to emerge the strongest from COVID in the long term but was also hit hard by COVID lockdowns and close ties to China. Copper prices have been particularly weak. The drop in domestic demand was especially acute and triggered a sharp slowdown in inflation.

Chile is poorly positioned for a bounce in demand and spending as lockdowns are lifted. It has pursued much more aggressive lockdowns than its counterparts in the region. The devastation to jobs and income growth will be hard to overcome.

Latin Losers

Argentina is close to negotiating a debt restructuring with its creditors including the IMF; debtors will receive some payments. Austerity measures coupled with lockdowns have exacerbated near-term weakness. March estimates of Argentina’s ability to service its debt now look overly optimistic. Another debt default by Argentina is widely expected within the next decade. Wash, rinse, repeat.

The only country with worse prospects in the region is Venezuela. Sanctions, corruption, gross mismanagement and COVID mean the oil producer is now forced to actually import its own oil.

Middle East and North Africa

The Middle East and North African countries have been hit with a double shock - COVID and a sharp drop in oil prices, which has exacerbated already weak fiscal positions. Worse yet, oil prices are expected to slip back below their break-even threshold for most oil producing countries in the medium term. Saudi Arabia and the United Arab Emirates are notable exceptions. They have much better funded sovereign wealth funds to blunt the blows to their economies than others in the region.

Tourism, which accounts for anywhere from 5% to 20% of GDP, further complicates the near-term outlook. Another problem is a sharp drop in remittances, which undermines living standards. The surge in cases in conflict zones such as Syria and Yemen will no doubt trigger another surge in refugees. The concern is that this will only solidify the rise in nationalism in Europe and the U.S.

Longer term, the concern is that efforts to shore up moribund economies will take away from structural reforms and efforts to diversify oil dependent economies. The economic situation in the Middle East will further deteriorate and stoke extremism at home and abroad.

Africa

The situation in sub-Saharan Africa was deteriorating pre-COVID. Falling commodity prices, including oil prices, trade wars and the accompanying slowdown in trade hit more open economies ahead of the pandemic. COVID is adding insult to injury, especially in terms of trade and support from China. Tourism has also been hit hard.

Monetary policies have been eased. There are some targeted relief programs. However, poor fiscal positions are limiting the magnitude of the fiscal response, while the corruption and cronyism could determine how funds are distributed.

Heavy rains have also triggered swarms of locusts - yes you read that right - which are damaging crops in East Africa. The first wave was in February. The second hit in May, when crops are the most vulnerable. The IMF is being tapped for emergency funds.

Many countries have long histories with epidemics, including Ebola, tuberculosis and AIDS. This has made their populations more willing to wear masks and engage in preventive measures. Their populations are also younger, which could limit deaths related to COVID. The downside is that HIV and tuberculosis could make the population more vulnerable to a second wave of infection, expected to start in August. Population density, lack of running water and basic health care also present hurdles to dealing with larger outbreaks.

Bottom line

The global economy is expected to reopen and recover to varying degrees. There is little doubt that COVID-19 has cast a long shadow, especially on emerging economies where lockdowns are less practical given their limited ability to provide fiscal and monetary aid. The result is less synchronous world growth than we have become accustomed to, with harder borders and more fragmented trade relationships. The virus will likely exacerbate the flow of refugees from the Middle East, which many fear will spur nationalism, notably in Europe.

The recent resurgence in cases in the U.S. is of particular concern as it could derail efforts to reopen states and further dampen the recovery. Additional lockdowns are not likely, especially in the worst affected states. That won’t stop people from being more cautious.

Older consumers have already been more proactive about avoiding large crowds. The young have yet to get the message and are finding out the hard way how devastating this disease truly remains, even as we discover better ways to treat it. Wearing a mask is the first step in mitigating what is still the first wave of infections.

I am old enough to remember the battle against wearing a seat belt, which was eerily similar. My father would refuse to drive until my aunt buckled up; we would sit for ages in the driveway as they debated government overreach in their personal lives.

Only 15% of the population regularly wore seat belts before states enacted fines for those who wouldn’t buckle up. That was despite research by the Department of Transportation at the time that showed a 45% to 55% drop in serious injury and death by the simple act of buckling up. They couldn’t see the costs they were imposing on themselves by driving without seat belts. States enacted fines in the mid-1980s to internalize that externality for people.

An even better analogy is the surge in fines and consequences for those who are caught driving while under the influence of alcohol or other drugs. They are not only risking their own lives but those of all they encounter while impaired. Traffic deaths, which include alcohol-impaired drivers, dropped more than 20% between 2006 and 2016, the most recent year for which data is available. The advent of ride sharing services also played a key role by offering impaired drivers more alternatives to get home safely.

The moral of the story. The virus is doing what it does - infecting people. The easiest and least costly way to stem those infections short of self-induced quarantines is to wear masks. Places where masks are ubiquitous have seen a sharp drop in the pace of infections. Seems a small inconvenience to save lives and the economy at the same time. Mask up.