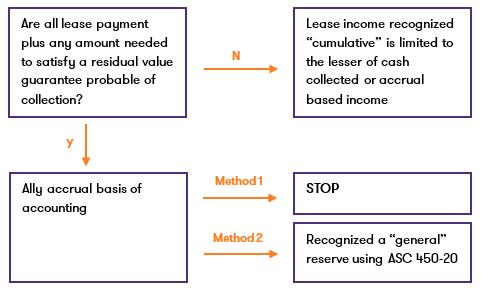

Two methods identified for operating lease receivable impairment accounting.

At its meeting on July 17, 2019, the FASB staff explained its view that there are two acceptable methods to account for the impairment of operating lease receivables after a lessor has adopted ASC 842, Leases:

Apply only the collectability guidance in ASC 842-30 to each lease

- recognize a general reserve for operating lease receivables based on ASC 450-20, Loss Contingencies, in addition to applying the collectability guidance in ASC 842-30

The staff recommended that the Board not undertake a standard-setting project related to operating lease receivables impairment. The Board will monitor practice in this area.

Operating lease receivable impairment analysis

Background

A lessor in an operating lease generally recognizes revenue on a straight-line basis and recognizes receivables related to uneven lease payments and amounts billed.

ASC 842-30 contains a model for assessing the impairment of operating lease receivables on a lease-by-lease basis by applying a constraint to the recognition of revenue. If the collectability of lease payments is not probable at the lease commencement date, revenue is recognized prospectively based on the lesser of a cash or accrual basis. If the collectability of lease payments is probable at the lease commencement date but collectability later becomes not probable, any straight-line revenue recognized as of the date the probability assessment changes in excess of cash received is derecognized as a current-period reduction to lease revenue. Thereafter, revenue is recognized on the lesser of a cash or accrual basis.

Under ASC 840, some lessors applied the guidance in ASC 310, Receivables, to accrue losses on a portfolio of operating lease receivables based on the guidance in ASC 450-20, which requires recognition of a loss when it is probable that an asset has been impaired and the amount of the loss is reasonably estimable. The guidance in ASC 310 will be superseded by the current expected credit loss (CECL) guidance in ASC 326.

ASU 2018-19 Improvements to Topic 326, Financial Instruments—Credit Losses, excludes operating lease receivables from the scope of the CECL guidance.

Stakeholders inquiry

Stakeholders noted that, according to the Basis for Conclusions in ASU 2016-02, it was not the Board’s intent to change the collectability guidance for operating lease receivables in previous GAAP. However, the guidance in ASC 842-30 indicates that recognition of a general reserve for a portfolio of operating lease receivables is not permitted once a lessor adopts ASC 842, which would be a significant change for some lessors. Also, stakeholders noted that the Board’s decision in ASU 2018-19 precludes lessors from applying the guidance that will replace ASC 310 to account for impairment of operating lease receivables. Accordingly, these stakeholders inquired of the FASB staff whether after adopting ASC 842 it is appropriate for lessors to continue to recognize a general reserve for a portfolio of operating lease receivables, based on the guidance in ASC 450-20.

FASB staff response

In response to this inquiry, the FASB staff stated that it believes neither the collectability guidance in ASC 842-30 nor the Board’s decision in ASU 2018-19 precludes an entity from recognizing a general reserve for a portfolio of operating lease receivables under ASC 450-20.

The FASB staff outlined two acceptable methods to account for the impairment of operating lease receivables:

- apply only the collectability guidance in ASC 842-30, on a lease-by-lease basis

- recognize a general reserve under ASC 450-20 in addition to applying the guidance in ASC 842-30, on a lease-by-lease basis

The FASB staff also noted that a lessor should disclose which of the two methods was used for accounting for impairment of operating lease receivables.

Method 1 Under the first approach, a lessor assesses collectability on a lease-by-lease basis.

For each individual lease, at the lease commencement date, the lessor determines whether it is probable that it will collect all of the lease payments and any residual value guarantee payment. If collectability is not probable, lease revenue is recognized based on the lesser of a cash or accrual basis. If collectability is probable, lease revenue is generally recognized on a straight-line basis.

After the lease commencement date, if payments previously deemed probable of collection become not probable, the lessor ceases to recognize revenue on a straight-line basis. The lessor evaluates whether cumulative straight-line revenue recognized to date exceeds cash collected and, if so, adjusts current-period lease revenue so that total lease revenue recognized from commencement to date is equal to total cash collected. Subsequently, the lessor recognizes lease revenue on the lesser of a cash or accrual basis.

Method 2 Under the second approach, an entity applies the lease-by-lease collectability guidance as described in Method 1, and also recognizes a general reserve under ASC 450-20 for a portfolio of operating lease receivables. The portfolio of operating lease receivables will include only leases for which collectability is assessed as probable in accordance with the guidance in ASC 842-30.

The general reserve would be based on historical collection experience relevant at the portfolio level. ASC 450-20 requires an entity to recognize a loss when it is probable that an asset has been impaired, and the amount of the loss is reasonably estimable.

Source:

Grant Thornton, On the Horizon July 25, 2019.

We are committed to keep you updated of all developments that may affect the way you do business in Puerto Rico. Please contact us for further assistance in relation to this or any other matter.