In May 2014 the Financial Accounting Standard Board (FASB) and the International Accounting Standard Board (IASB) published their largely converged standards on revenue recognition. Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers, and IFRS 15 with the same title, created a new principle-based revenue recognition framework that will affect nearly every revenue-generating entity.

ASU 2014-09 creates a new topic in the FASB Accounting Standards Codification® (ASC or Codification), Topic 606. In addition to superseding and replacing nearly all existing U.S. GAAP revenue recognition guidance, including industry-specific guidance. ASC 606 is a single, principle-based model for recognizing revenues in a manner that depict the transfer of goods and/or services to a customer in an amount that reflects the consideration to which it expects to be entitle in exchange for those goods and/or services.

Applicability

ASC 606 applies to all contracts to provide goods or services to customers, except for leases, insurance contracts, financial instruments, and certain guarantees and non-monetary exchanges. This standard clarifies the principle for recognizing revenue and develops a common revenue standard for US GAAP and IFRS that would:

- eliminate inconsistencies and weaknesses in revenue requirements

- provide a more robust framework for addressing revenue issues

- improve comparability of revenue recognition practices across entities, industries, jurisdictions, and capital markets

- provide more useful information to user of financial statements through improved disclosure requirement, and

- simplify the preparation of financial statements by reducing the number of requirements to which the entity must refer.

Core principle

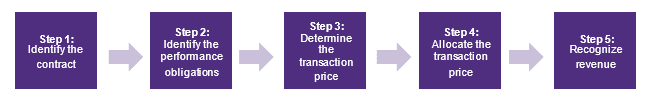

The core principle of this Topic is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The new standard requires entities to evaluate contracts with customers using a new five-step model and introduces extensive new disclosure requirements about contracts with customers and presents an overall disclosure objective.

Steps for Achieving the Core Principle

To achieve the core principle of ASU 2014-09, an entity should perform the following five-steps model:

In addition, ASU 2014-09 adds a new Subtopic to the Codification, ASC 340-40, Other Assets and Deferred Costs: Contracts with Customers, to provide guidance on costs related to obtaining a contract with a customer and costs incurred in fulfilling a contract with a customer that are not in the scope of another ASC Topic.

This Standard supersedes most of the revenue recognition requirements in Topic 605, as well as most industry-specific guidance throughout industry topics of the codification. This Standard also supersedes some cost guidance included in subtopic 605-35 Revenue Recognition – Construction Type and Production Type Contracts, which are not typically just sales situations.

How the new standard will change current GAAP?

|

Before ASC 606 |

After ACS 606 |

|

Numerous requirements for recognizing revenue |

Consistent principles for recognizing revenue, regardless of industry and/or geography |

|

Limited information about revenue contracts |

Cohesive set of disclosure requirements |

|

Many indistinct revenue-generating transactions but separate obligations |

Identity of each good or service and determination if a performance obligation and when is recognized |

|

Limit to amount not contingent on future delivery of goods/services |

Allocation of price to obligations – stand-alone selling price |

|

Variable consideration accounting differs across industries |

Single model |

When is effective?

The guidance in ASC 606 and ASC 340-20 is effective for public entities for annual reporting periods beginning after December 15, 2017, including interim periods within those years. Nonpublic entities are required to apply the guidance in annual periods beginning after December 15, 2018 and in interim periods beginning after December 15, 2019. All entities may early adopt the new guidance, but not before annual reporting periods beginning after December 15, 2016.

We recommend you to carefully evaluate the effects of the new revenue standard including its disclosure requirements to achieve a successful implementation.

Resources:

Module 1: Top Accounting Issues- Chapter 2: The Impact of Revenue Recognition Changes: ASU 2014-09 from Top Accounting and Auditing Issues for 2018 - Wolters Kluwer by Patrick Patterson, CPA and James F. Green, CPA

New Developments Summary- “Revenue recognition take two” by Grant Thornton US

Revenue from Contracts with Customers- “Navigating the guidance in ASC 606 and ASC 340-40” by Grant Thornton US

We are committed to keep you updated of all developments that may affect the way you do business in Puerto Rico. Please contact us for further assistance in relation to this or any other matter.