-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Tax compliance

Business Tax

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives

Navigating the complex landscape of tax incentives in Puerto Rico can be challenging. Whether you're looking to benefit from the Export Services Act (Act 20), the Individual Investors Act (Act 22), or other incentives under Act 60, we provide tailored advice to help you maximize your tax benefits and ensure compliance. Let us help you unlock the potential of doing business in Puerto Rico.

-

Transfer Pricing

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Business Risk Advisory

Risk is inevitable but manageable. We deliver relevant, timely and practical advices to aid organizations manage risk and improve business performance. We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Technology Advisory

We provide comprehensive solutions to safeguard your business and ensure operational resilience and compliance. Our expert team offers a range of technology advisory services designed to address your cybersecurity needs, enhance business continuity, and manage security effectively.

-

Transactional advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

This article was prepared by:

Ashly Lasanta, Supervisor, Tax

Yarixa Garcia, Senior, Tax

It’s been almost two years since Act 52-2022 introduced a noteworthy change to Puerto Rico's income tax regime by adopting the Disregarded Entity (DE) treatment. This change aligns Puerto Rico’s taxation treatment of single-member entities with the one established by the U.S. federal tax code for DE. Its purpose is to foster local parity for owners who have elected this option for their entities in the U.S. One key aspect to consider is that certain local rules for DEs may differ from the ones established in the U.S.

Back in 2022, the particularities regarding DEs were in the newborn stage. To clarify the tax implications of DE and provide the ground rules on the treatment of certain transactions with them, the Puerto Rico Department of the Treasury (“PRTD”) issued Administrative Determinations 22-10 (DA 22-10) and 23-01 (DA 23-01). In our previous article, Puerto Rico Opens Its Doors to Disregarded Entities we explained that despite the initial clarification, Act 52, and the issued guidance, some matters still needed clarification.

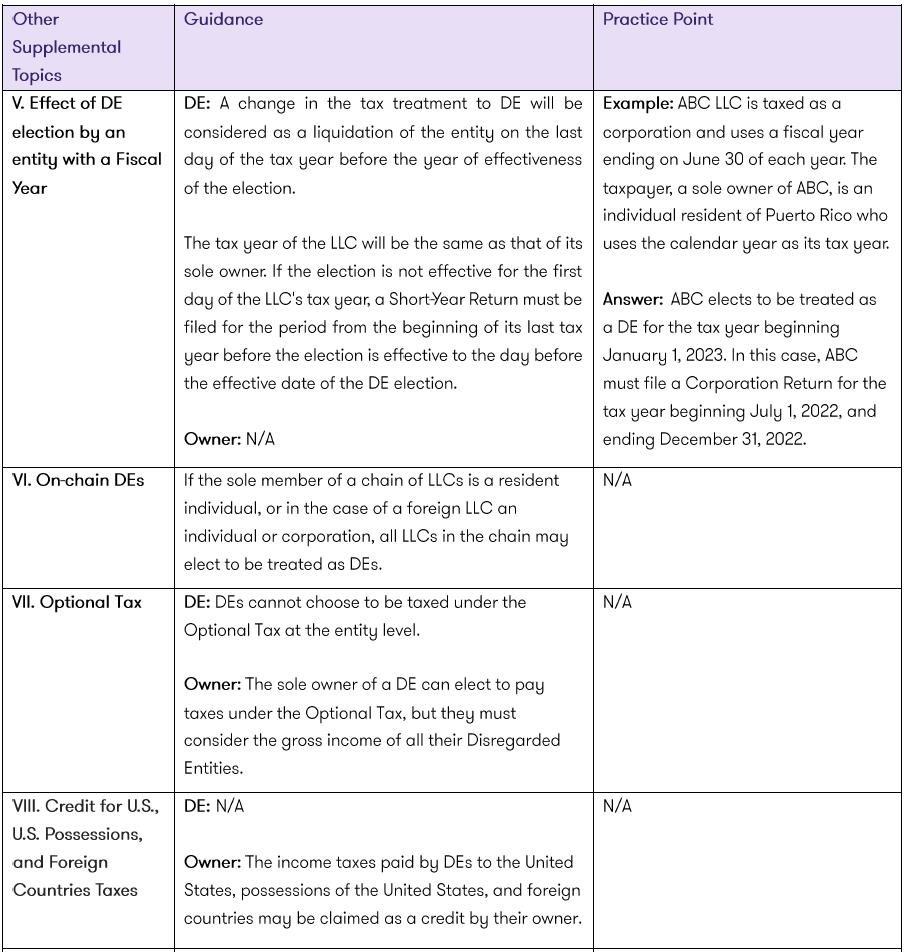

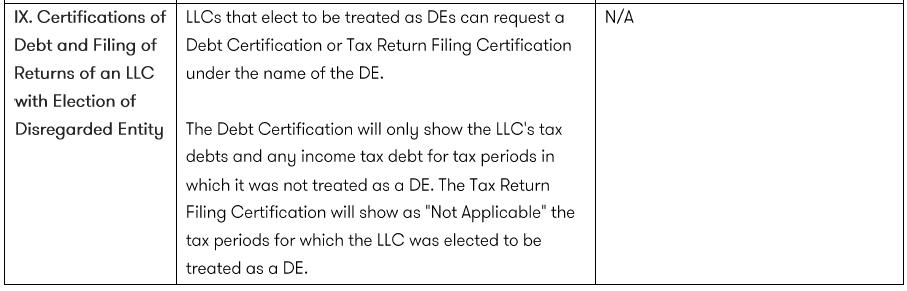

On January 30, 2024, the PRTD issued Circular Letter 24-02 (CL 24-02) to complement previous guidance and clarify aspects that remained open on the tax treatment of DEs. This letter addressed the following matters:

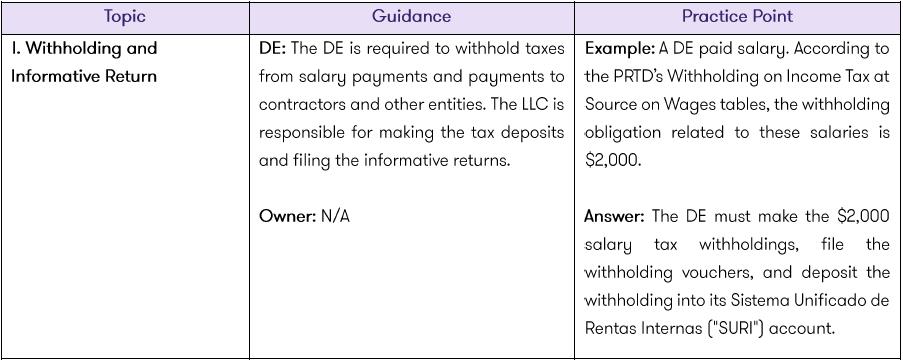

- (i) The obligation of the DE to withhold the tax at source and file the corresponding withholding vouchers and informative returns.

- (ii) How the DE owner can claim withheld taxes made to the DE and estimated tax payments made by the DE during the tax year on their income tax return.

- (iii) How the DE owner married under the community property regime should report the operations of a DE when filing jointly with their spouse.

- (iv) The effect of an entity’s election of a DE with a fiscal year.

- (v) The operations of a DE that are considered as "Principal Industry or Business" when the sole owner is an individual.

Additionally, CL 24-02 clarifies the treatment of:

- (vi) DEs in a chain structure;

- (vii) Optional tax under Sections 1021.06 and 1022.07 of the Puerto Rico Internal Revenue;

- (viii) Credit for Contributions from the United States, Possessions, and Foreign Countries; and

- (ix) Debt Certifications and Filling Requirements for LLCs with the DE election.

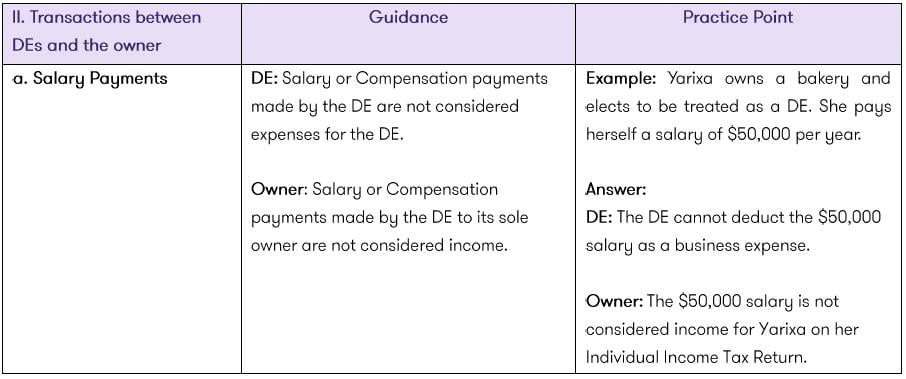

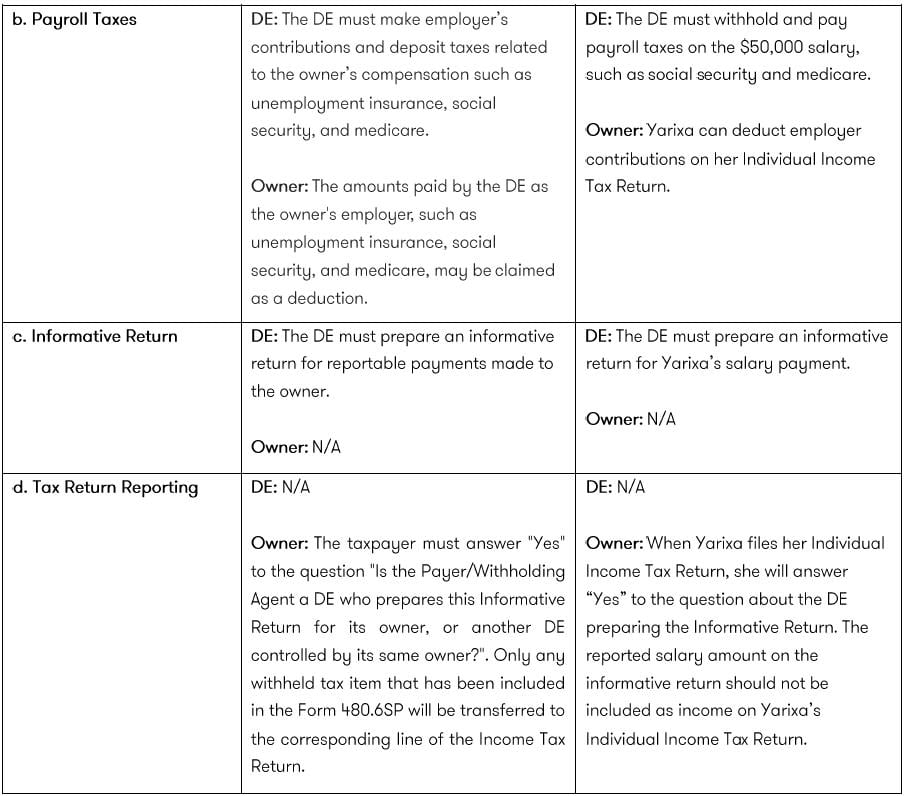

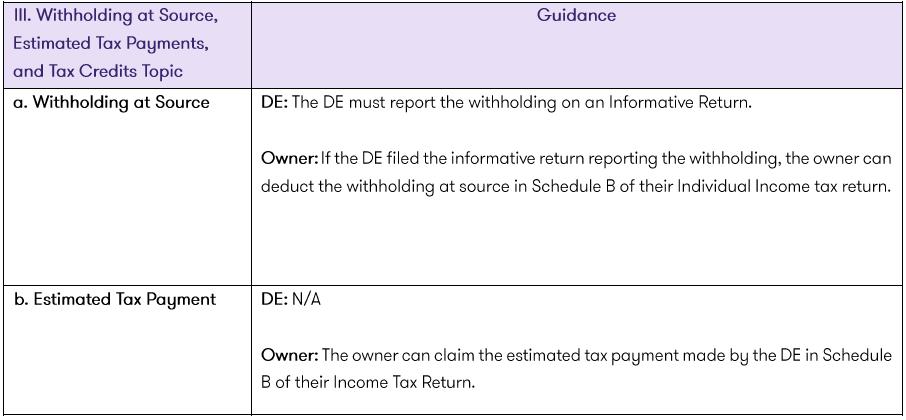

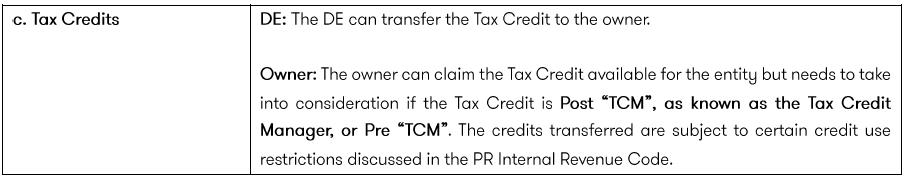

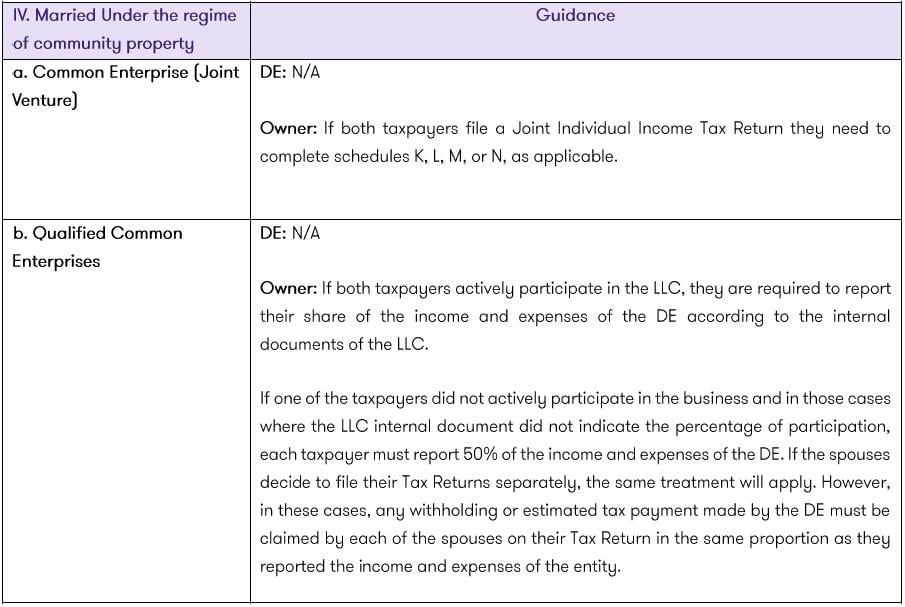

We have summarized these relevant topics in the table below to serve as a quick reference guide. We have segregated the implications of several topics between the entity and the owner.

Bottom line

The recent publications issued by the Puerto Rico Treasury on DEs offer valuable insights and considerations for taxpayers evaluating business structuring options. Careful evaluation is essential when determining the most appropriate business structure for your specific needs. Our team of tax professionals is available to assist you in evaluating whether a DE is the optimal choice for your organization. Please contact our Tax Department should you require additional information regarding this or any other tax issue.