As part of the initiatives of the Fiscal Plan established by the Puerto Rico Municipal Revenue Collection Center (“CRIM” for its acronym in Spanish) certified by the Financial Oversight & Management Board of Puerto Rico, the CRIM is required to take certain actions with respect to accounts showing outstanding debts on their records. In an effort to search for alternative measures to provide taxpayers with a final opportunity to be compliant and pay any outstanding debts over real property taxes due, “Regulation No. 9323: Taxpayer’s Benefit for the Payment of Debts” (“Regulation No. 9323”) was approved on September 2021 to establish the “Program for the Collection of Outstanding Debts” (the “Program”) granting discounts over amounts due for certain fiscal years.

Purpose

Regulation No. 9323 grants all taxpayers and the CRIM, the opportunity to clarify any situation related to real property including, but not limited to, ownership, taxation, records, among other matters, without losing the benefit of claiming any discounts.

Who qualifies?

Any natural or legal person that owes real property taxes as of fiscal year ending on June 30, 2020 (excluding fiscal years 2020-2021 and 2021-2022).

- taxpayers must be current on the payment of real property taxes for the fiscal years 2020-2021 and 2021-2022.

- payment plans are available for taxpayers that are unable to make a lump-sum payment for any amount due corresponding to these two (2) fiscal years; the term of the payment plan may not exceed one (1) year.

- taxpayers under the process of an intervention, tax audit, administrative hearing or judicial review may enjoy the benefits of the Program, which may lead to the cease of any investigation process with respect to the outstanding debts that are being subject to the Program.

- taxpayers that have presented an application for self-assessment under Article 7.062 of Act 107-2020 do not qualify for these benefits.

- government officials do not qualify for these benefits.

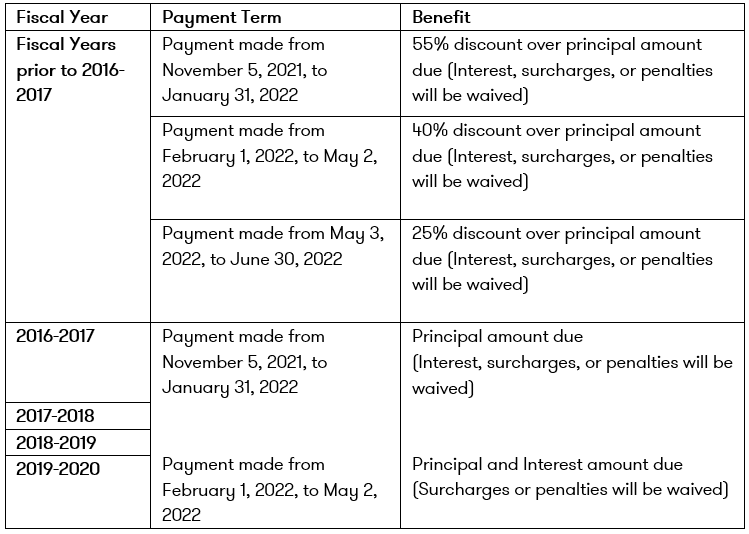

Benefits and Payment Requirements on outstanding debts for Real Property Taxes

Additional Terms

- taxpayers with payment plans, or other agreements with the CRIM may request the renegotiation of the terms of any balance due under the plan subject to certain terms and restrictions.

- taxpayers enjoying the benefits from the Program will not be able to make objections or claims over the assessment of the debts covered.

- payments under the Program will be final and not subject to further claims from CRIM.

Effectiveness

- payments must be made no later than June 30, 2022, subject to the terms and benefits discussed above.

Caroline López, CPA, Esq.

Tax Manager

Jennifer Ortiz

Tax Supervisor

Ian López

Tax Staff

Collaborated in the preparation of this article.