-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Tax compliance

Business Tax

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives

Navigating the complex landscape of tax incentives in Puerto Rico can be challenging. Whether you're looking to benefit from the Export Services Act (Act 20), the Individual Investors Act (Act 22), or other incentives under Act 60, we provide tailored advice to help you maximize your tax benefits and ensure compliance. Let us help you unlock the potential of doing business in Puerto Rico.

-

Transfer Pricing

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Business Risk Advisory

Risk is inevitable but manageable. We deliver relevant, timely and practical advices to aid organizations manage risk and improve business performance. We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Technology Advisory

We provide comprehensive solutions to safeguard your business and ensure operational resilience and compliance. Our expert team offers a range of technology advisory services designed to address your cybersecurity needs, enhance business continuity, and manage security effectively.

-

Transactional advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

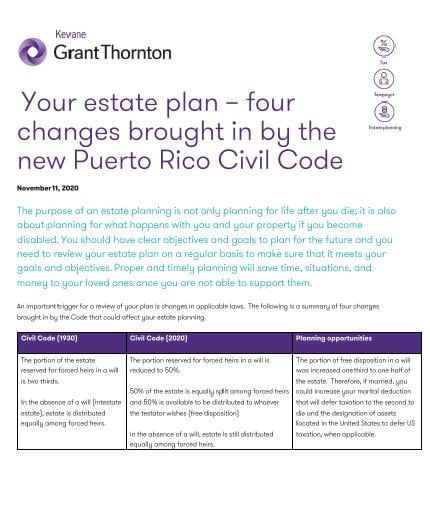

The purpose of an estate planning is not only planning for life after you die; it is also about planning for what happens with you and your property if you become disabled. You should have clear objectives and goals to plan for the future and you need to review your estate plan on a regular basis to make sure that it meets your goals and objectives. Proper and timely planning will save time, situations, and money to your loved ones once you are not able to support them.

An important trigger for a review of your plan is changes in applicable laws. The following is a summary of four changes brought in by the Code that could affect your estate planning.

|

Civil Code (1930) |

Civil Code (2020) |

Planning opportunities |

|

The portion of the estate reserved for forced heirs in a will is two thirds. In the absence of a will (intestate estate), estate is distributed equally among forced heirs. |

The portion reserved for forced heirs in a will is reduced to 50%. 50% of the estate is equally split among forced heirs and 50% is available to be distributed to whoever the testator wishes (free disposition) In the absence of a will, estate is still distributed equally among forced heirs. |

The portion of free disposition in a will was increased one third to one half of the estate. Therefore, if married, you could increase your marital deduction that will defer taxation to the second to die and the designation of assets located in the United States to defer US taxation, when applicable. |

|

Surviving spouse is in a third order of succession. First order were descendants, second ascendants and in the absence of both, surviving spouse was the heir. |

Surviving spouse is a forced heir. The Code adds the surviving spouse to the first order of succession as forced heir. Therefore, as an example, in an intestate estate with community property regime and three children, each will inherit 25% of the estate. In this same case if there are no children then the surviving spouse will inherit 100%. |

A will may be used to formalize your wishes with respect to this new change. |

|

Gifts to forced heirs are treated as an inheritance advance and should be included in the estate to determine any adjustment to other forced heirs. |

Gifts to forced heirs are still treated as inheritance advance but have a term of 10 years to be considered as part of the estate. Therefore, if 10 years or more from the time of the gifts had already passed at the time of death, the same will be excluded from the estate computation. The Code also excludes from the estate computation usual gifts, food, education, and assistance in relative diseases within the fourth degree, even if the decedent did not have an obligation to pay for those expenses. |

Plan to make lifetime gifts and formalize them through deeds and gift tax returns to document effective date of the gift and elapse of ten-year period. |

|

Gifts between spouses are prohibited. |

Eliminate prohibition of gifts between spouses. Rule of 10 years or more will apply with certain exceptions. |

Plan to make lifetime gifts and formalize them through deeds and gift tax returns to document effective date of the gift and elapse of ten-year period. |

The following questions will help in the review and update of your estate tax plans due to recent changes in the law:

- What taxes could affect your estate?

- Have you considered federal tax implications? Are you aware of possible changes in the future?

- Who owns the property?

- Are prenuptial or postnuptial agreements still valid after death?

- What are the options to transfer your estate to your heirs or beneficiaries?

- If you have a family business, do you have a proper succession planning for disability or death?

- Do you need to create a trust or an entity for asset protection?

- Are the rights beneficiaries named in your insurance policies and other investment instruments?

- Are plans updated to include digital assets?

- Are named executors or fiduciaries still alive, sound mind and body or ever still the desired executors or fiduciaries?

- Has there been change in domicile, key life events (birth, death of loved ones, marriage, remarriage, blended families, divorce, disability, etc.)?