The Opportunity Zones program provides tax incentives to taxpayers that elect to defer the recognition of capital gains and invest these gains (in total or partial amounts) in Qualified Opportunity Funds (“QOF”). The success of the investors in obtaining these tax benefits relies in the proper and correct compliance with all the rules and regulations promulgated by the Law and its proposed regulations. There are, literally, tests and valuations to be made in all aspects and during the full life of the investment. That is why the correct and timely guidance of a CPA is fundamental. A CPA, with knowledge of the Law and regulations and that continuously monitors developments in the space, will help you navigate the maze of tests that the investors, the funds and the businesses must comply with in order to secure the special tax treatment.

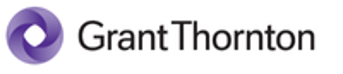

Before we review some of these tests, let us go over the basic principles involved in the Opportunity Zones program and how does it work. The following graph summarizes the major steps in the timeline of the investment in the QOF.

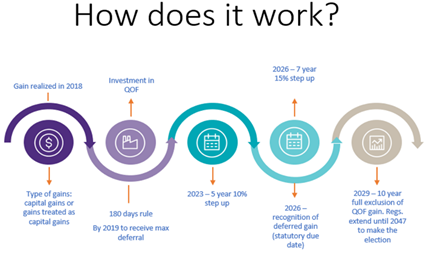

The following are the very basic principles that must be considered and understood when seriously considering investing in a QOF.

An eligible taxpayer is a person that may recognize gains for federal income tax purposes. It includes individuals, C corporations (including RICs and REITs), partnerships, S corporations, trusts and/or estates. An eligible gain is a gain that is treated as a capital gain (includes Section 1231 gains) for federal income tax purposes that would be recognized before January 1, 2027 and does not arise from a sale or exchange with a person that is a related party ( as defined) to the taxpayer that recognizes the gain. The 180 days period begins on the same day on which the gain would be recognized for federal income tax purposes if the taxpayer did not elect to defer the gain recognition. An eligible interest is an equity interest in a QOF, including preferred stock or a partnership interest.

Each one of the players (investors, QOF and businesses) must pay close attention to the tests and compliance measures and dates required to properly obtain the deferral and exclusion of the capital gains. For example:

Investors:

Need to determine that they have a qualified capital gain and that they invest it (a similar amount) in a QOF within the 180 days of recognition for tax purposes (including the day in which it is realized). In addition, a timely election must be done by the investor in the corresponding tax return using Form 8949: Sales and Other Dispositions of Assets. Moreover, and depending on their needs and priorities, if the investment is kept at least for 10 years, another election to exclude the gain must be done for the year of disposition. There are special safe harbor rules that allow for the continuation of the deferral when interim dispositions or distributions are received. These require reinvestment of the proceeds within certain parameters.

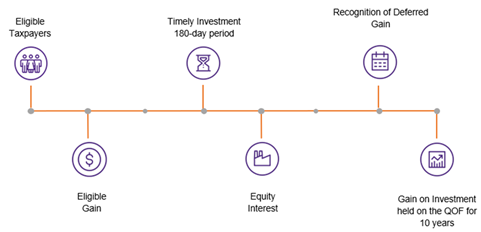

The QOF:

Even though the fund auto certifies, it must meet the 90% investment in qualified opportunity zone property every six months. Form 8996 is used to report compliance with the 90% test as well as for the calculation of the penalty in case of no compliance. There are valuation methods and safe harbor rules that make this compliance test, a very intricated process. If the QOF invests in Qualified Opportunity Zones Businesses, these will need to provide support of their compliance with the tests detailed below, in order for the fund to ensure compliance with the 90% test.

The Qualified opportunity zone business

The first requirement is that the business must be an active business. For these purposes, the rent of property will also be considered an active business. However, leases known as "triple net leases" where the tenant is responsible for all costs (insurance, maintenance and taxes) related to the property in addition to the rent, are not considered an active business. Once we determine that the business conducts an active business, it must meet the following requirements:

- Not considered a “sin business”,

- The business meets the following tests:

- at least 50% of its gross income is generated in a QOZ

- at least 40% of intangible assets are used in a QOZ

- less than 5% of its assets are non qualified financial assets, and

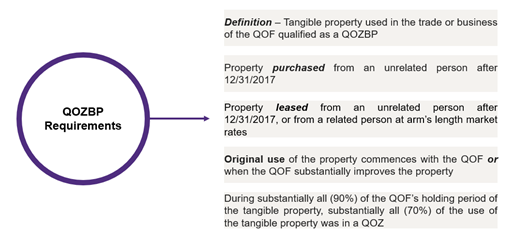

- Substantially all (70%) of the tangible property owned or leased by the trade or business is Qualified Opportunity Zone Business Property (“QOZBP”)

The activity carried out by the business cannot be one of the following referred to as sin businesses:

- public or private golf course

- country club

- massage parlor

- hot tub facilities

- tanning facilities

- racetracks or betting facilities

- selling alcoholic beverages for consumption outside the business.

To satisfy the rule of generating at least 50% of gross income from an active business in an area, one of the following tests may be used:

- at least 50% of the hours related to the services provided by the business are incurred in an area,

- at least 50% of the fees paid for services for the business are performed in an area,

- the assets of the business located in the area and the management or operational functions carried out in the area are necessary to generate at least 50% of the gross income of the business, or

- based on the facts and circumstances, at least 50% of the business is generated from a commercial activity in an area.

An important exception to the financial assets rule (investments, bonds, etc.) is that the business can maintain a reasonable amount of working capital (cash or investments with terms of 18 months or less) as long as the business has a formal plan to use them within 31 months of their contribution to the business.

For all these tests, there are different valuation and computation methods that may be applied as well as safe harbor rules.

Investors in the fund will certainly request proof of compliance to the QOF and the fund in turn, in order to provide this proof, must also require compliance reports from the individual businesses. There is where the services and support of a trusted and independent CPA will be crucial. CPA’s can perform Agreed Upon Procedures services in order to provide a level of assurance that the QOF and its investments are following all the required tests. In addition, your trusted CPA will be able to assist you in making all the necessary elections and filings on time.

Do not enter the zone alone!

Please contact our Tax Department should you require additional information regarding this or any other tax issue. We will be glad to assist you.