Puerto Rico offers various tax exemption grants to eligible entities, providing significant tax advantages and growth opportunities. Knowing the Sales and Use Tax (“SUT”) implications for entities that are beneficiaries of tax exemption grants is crucial for effective planning, establishing goals, and strategies, as well as minimizing the impact on the organization's finances.

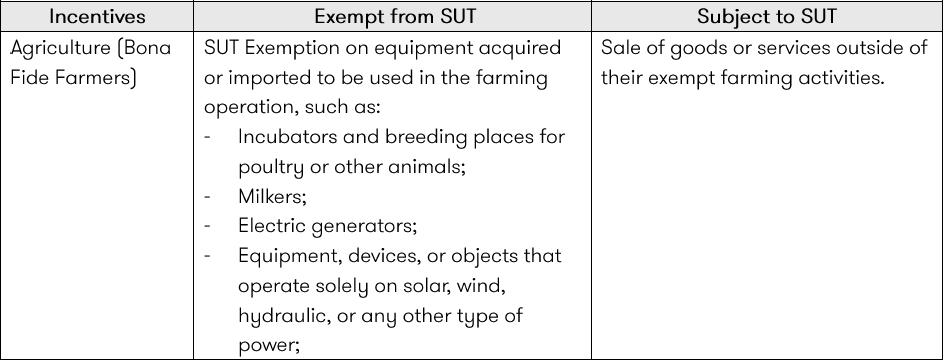

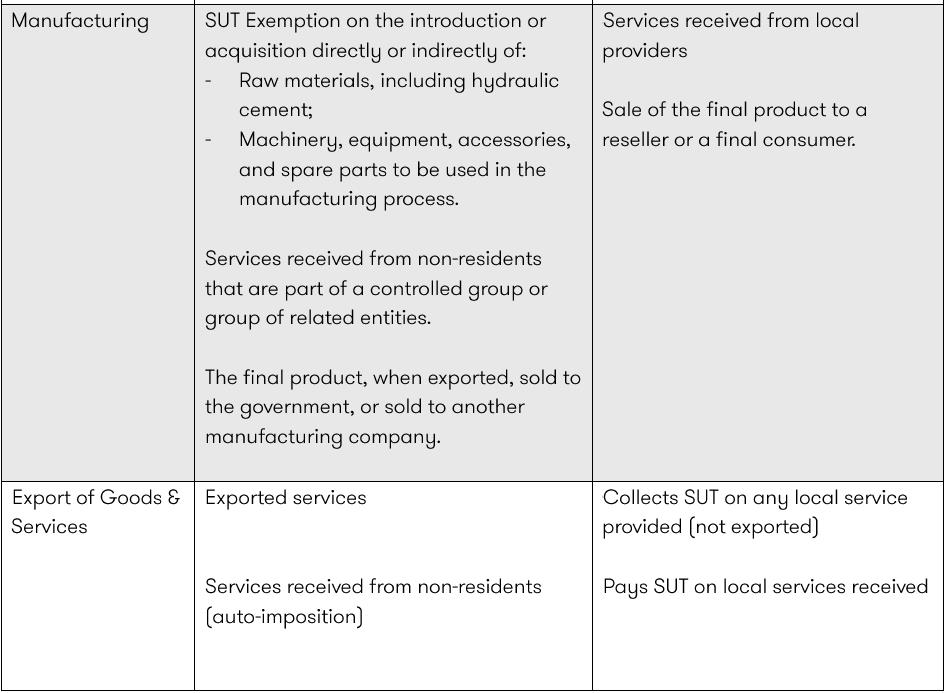

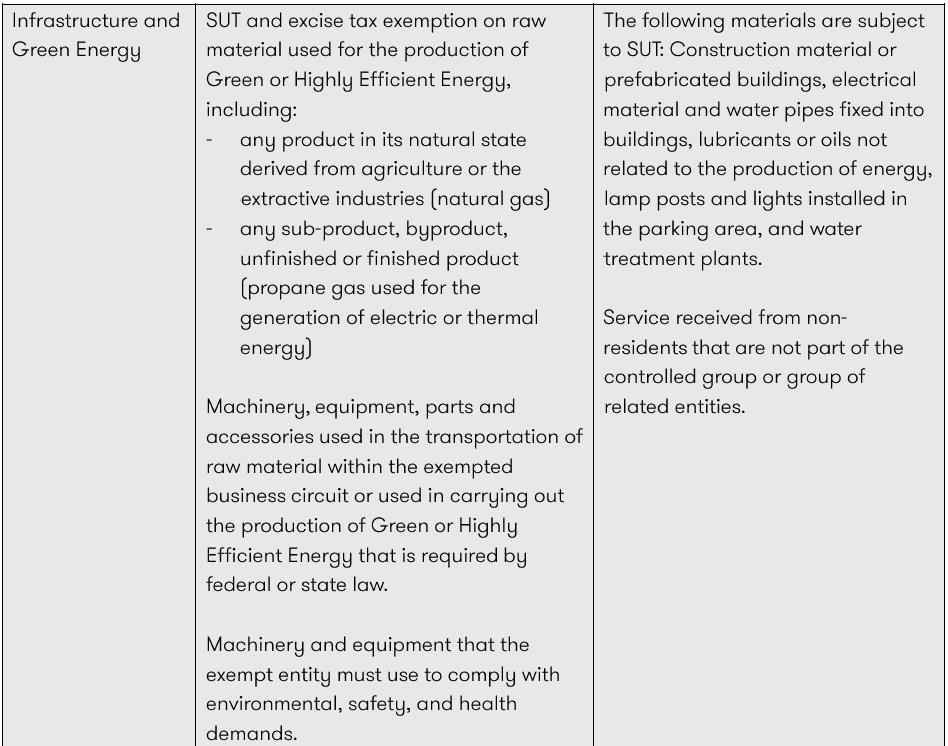

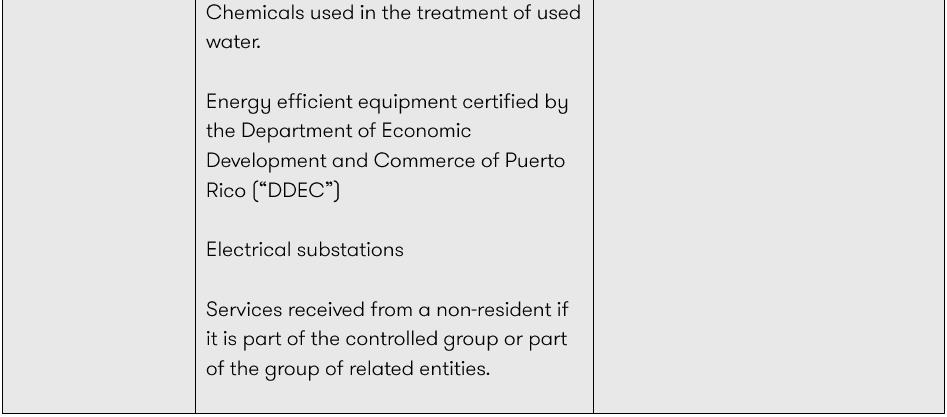

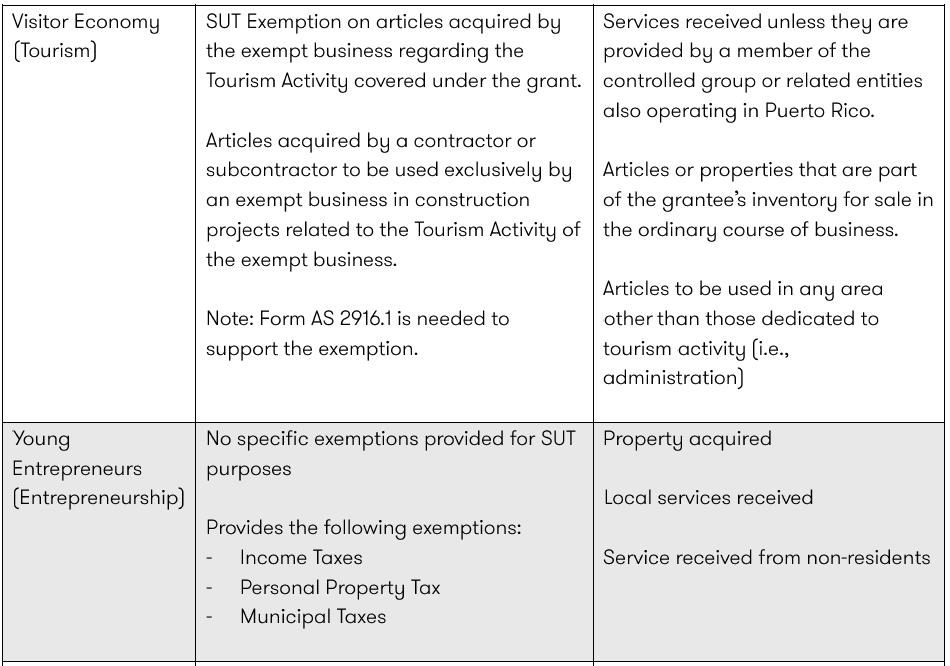

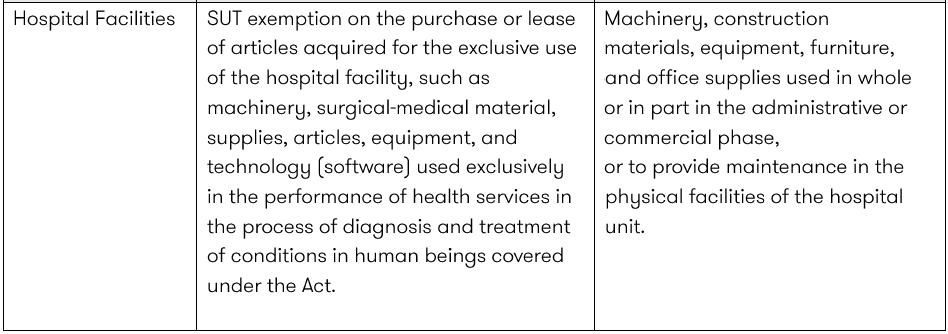

Our goal is to ensure you have a comprehensive understanding of these SUT considerations, enabling you to make informed decisions and fully capitalize on the available benefits. The following table outlines seven of the most common tax incentives available, detailing the areas in which SUT exemptions apply, as well as those subject to taxation, according to the Puerto Rico Internal Revenue Code of 2011, as amended (“PRIRC”), Act 60 of July 1, 2019, as amended, known as the Puerto Rico Incentives Code (“Act 60-2019”), and the SUT Regulations.

As always, we are committed to helping you navigate Puerto Rico's tax environment and keep you up to date with all tax-related developments. Please contact our Tax Department for additional information on the incentives discussed above or any other available incentives. We will gladly assist you.