-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Corporate and business tax

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Tax compliance

Business Tax

-

Individual taxes

Individual taxes

-

Estate and succession planning

Estate and succession planning

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives program

Tax incentives program

-

Transfer Pricing Study

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Fraud and investigations

The commercial landscape is changing fast. An ever more regulated environment means organizations today must adopt stringent governance and compliance processes. As business has become global, organizations need to adapt to deal with multi-jurisdictional investigations, litigation, and dispute resolution, address the threat of cyber-attack and at the same time protect the organization’s value.

-

Dispute resolutions

Our independent experts are experienced in advising on civil and criminal matters involving contract breaches, partnership disputes, auditor negligence, shareholder disputes and company valuations, disputes for corporates, the public sector and individuals. We act in all forms of dispute resolution, including litigation, arbitration, and mediation.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Internal audit

We work with our clients to assess their corporate level risk, identify areas of greatest risk and develop appropriate work plans and audit programs to mitigate these risks.

-

Service organization reports

As a service organization, you know how important it is to produce a report for your customers and their auditors that instills confidence and enhances their trust in your services. Grant Thornton Advisory professionals can help you determine which report(s) will satisfy your customers’ needs and provide relevant information to your customers and customers’ auditors that will be a business benefit to you.

-

Transaction advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Mergers and acquisitions

Globalization and company growth ambitions are driving an increase in M&A activity worldwide as businesses look to establish a footprint in countries beyond their own. Even within their own regions, many businesses feel the pressure to acquire in order to establish a strategic presence in new markets, such as those being created by rapid technological innovation.

-

Valuations

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Recovery and reorganization

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

Suspicious terms of agreement Fraud has well-known financial and reputational ramifications. But if your organization is like many others, “It can’t happen here” is a pervasive belief. When held by leadership, there’s no chance that risk management will be taken seriously. Significant fraud avoidance and mitigation are built on top-level awareness and commitment, and effective assessment to direct risk management activities.

Ignoring the potential for fraud is expensive. According to the Report to the Nations, released in 2016 by the Association of Certified Fraud Examiners (ACFE), a typical organization loses 5% of its annual revenues to fraud. Losses can mount much higher.

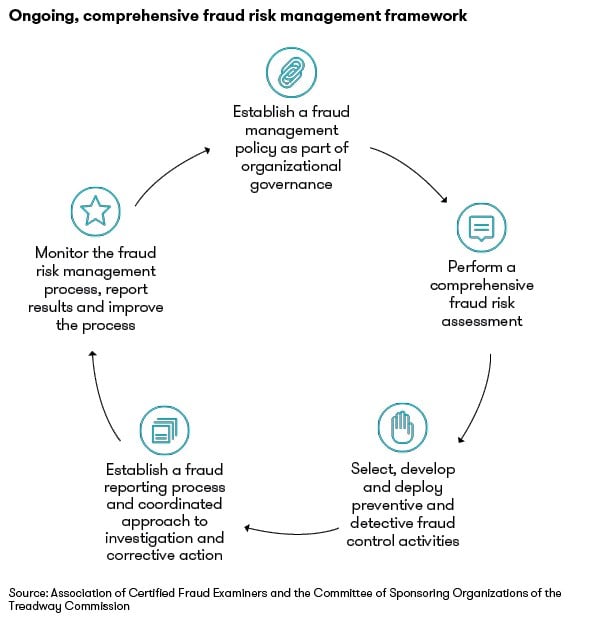

The five phases of fraud management:

- establish governance with top-level anti-fraud commitment

- create a formal fraud risk assessment process

- develop control activities aimed at the highest fraud risk areas

- implement fraud reporting and investigation procedures

- ensure oversight and monitoring of internal controls and new schemes

Commit to fraud risk management from the top

While it’s easy to acknowledge that fraud prevention is the most cost-effective approach, proactivity isn’t always on the agenda. Too often awareness comes as a hard lesson. Avert such lessons by raising awareness to the level of a C-suite priority.

C-suite executives getting ahead of issues by charging senior executives with fraud risk management responsibilities. This commitment is the first of the five phases of a productive fraud risk management program. Direction for all the phases can be found in the Fraud Risk Management Guide, issued jointly in 2016 by the ACFE and the Committee of Sponsoring Organizations of the Treadway Commission. A similar approach to anti-fraud programming is described in Framework for Managing Fraud Risks in Federal Programs, the U.S. Government Accountability Office guide issued in July 2015.

The overarching phase — second only to commitment — is a comprehensive, enterprise-level fraud risk assessment.

Assess your fraud risk exposure, current and future

Your staff and stakeholders, who know the day-to-day workings of the organization, are the best source of a realistic fraud risk assessment. Structure a process to capture their on-the-ground experiences, perceptions and risk fears.

At the start of the assessment process, describe common fraud scenarios to which your organization might be vulnerable. Write fraud risk questions to determine the likelihood of the scenarios becoming reality, as well as impacts that could be anticipated. Then launch the collection procedure.

The initial fraud risk assessment is a baseline. Incorporate subsequent assessments to continuously raise awareness of and commitment to fraud in its many forms.

Help staff and stakeholders buy into assessments

Explain assessment as a collaboration to identify and mitigate vulnerabilities. Make fraud risk a comfortable subject to discuss. When “risk” is not a menacing word, stakeholders are more inclined to consider the possibilities of fraud. They’re also more likely to provide honest feedback if they feel safe from accusations when pointing out weak or missing controls.

Reduce trepidation through survey questions that minimize room for negative interpretation. Ask process-specific rather than personal-responsibility questions. Instead of “How effectively do you verify self-reported information?” ask, “Do you verify self-reported information in applications? If so, how many databases do you check? Do you use internal or third-party data? Have there been reliability concerns with verification data?” Responses will be more reliable because respondents will be less tempted to say all is fine.

Reliability will also hinge on the clarity of questions. Asking about risk likelihood and impact on a five-point scale will yield only a number from 1 to 5. For example, a question might ask for ranking exposure of personally identifiable information. Some respondents might interpret the risk as large-scale cyberattacks and some as printouts mistakenly left on a desk. The two events are very different. A better approach is to pose narrow, standardized questions. You could ask about the strength of controls to protect potential entry points, e.g., product types and channels. Answers can be converted into a rubric, with a quantitative risk score for each function. Results will identify the most crucial risk areas.

Facilitate fraud risk workshops

Address crucial risk areas with regular anti-fraud training. Keep in mind that people often assume best intentions. This tendency can skew the ability to make unbiased judgments. To nurture a fraud risk–aware culture, encourage healthy scepticism. Make sure that every training session promotes critical thinking and reports on internal or external events of any size.

A practical component of training is a schedule of facilitated workshops. In your workshops, assign participants the role of fraudster and prompt them to describe how they might perpetrate schemes. Allow time for open discussion of questionable activities and other possible warning signs. Note detected and emerging threats for updating your fraud scenario library.

Back your fraud risk management program with awareness throughout the organization, starting with commitment at the top, and assessment that directs the next phases of fraud prevention and mitigation.

We are committed to keep you updated of all developments that may affect the way you do business in Puerto Rico. Please contact us for assistance in relation to this or any other matter, we will be glad to assist you.