-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Corporate and business tax

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Tax compliance

Business Tax

-

Individual taxes

Individual taxes

-

Estate and succession planning

Estate and succession planning

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives program

Tax incentives program

-

Transfer Pricing Study

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Fraud and investigations

The commercial landscape is changing fast. An ever more regulated environment means organizations today must adopt stringent governance and compliance processes. As business has become global, organizations need to adapt to deal with multi-jurisdictional investigations, litigation, and dispute resolution, address the threat of cyber-attack and at the same time protect the organization’s value.

-

Dispute resolutions

Our independent experts are experienced in advising on civil and criminal matters involving contract breaches, partnership disputes, auditor negligence, shareholder disputes and company valuations, disputes for corporates, the public sector and individuals. We act in all forms of dispute resolution, including litigation, arbitration, and mediation.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Internal audit

We work with our clients to assess their corporate level risk, identify areas of greatest risk and develop appropriate work plans and audit programs to mitigate these risks.

-

Service organization reports

As a service organization, you know how important it is to produce a report for your customers and their auditors that instills confidence and enhances their trust in your services. Grant Thornton Advisory professionals can help you determine which report(s) will satisfy your customers’ needs and provide relevant information to your customers and customers’ auditors that will be a business benefit to you.

-

Transaction advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Mergers and acquisitions

Globalization and company growth ambitions are driving an increase in M&A activity worldwide as businesses look to establish a footprint in countries beyond their own. Even within their own regions, many businesses feel the pressure to acquire in order to establish a strategic presence in new markets, such as those being created by rapid technological innovation.

-

Valuations

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Recovery and reorganization

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

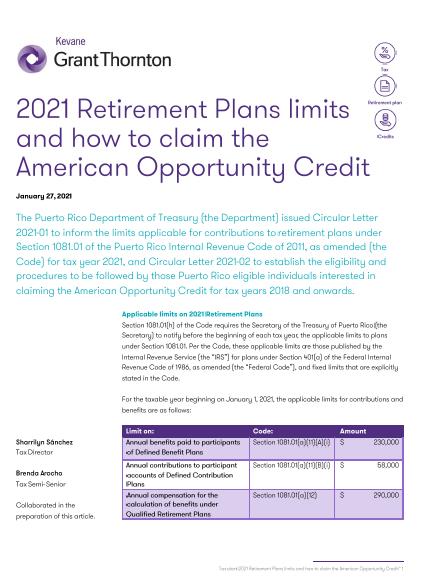

Applicable limits on 2021 Retirement Plans

Section 1081.01(h) of the Code requires the Secretary of the Treasury of Puerto Rico (the Secretary) to notify before the beginning of each tax year, the applicable limits to plans under Section 1081.01. Per the Code, these applicable limits are those published by the Internal Revenue Service (the “IRS”) for plans under Section 401(a) of the Federal Internal Revenue Code of 1986, as amended (the “Federal Code”), and fixed limits that are explicitly stated in the Code.

For the taxable year beginning on January 1, 2021, the applicable limits for contributions and benefits are as follows:

Limit on: |

Code: |

Amount |

|

Annual benefits paid to participants of Defined Benefit Plans |

Section 1081.01(a)(11)(A)(i) |

$230,000 |

|

Annual contributions to participant accounts of Defined Contribution Plans |

Section 1081.01(a)(11)(B)(i) |

$58,000 |

|

Annual compensation for the calculation of benefits under Qualified Retirement Plans |

Section 1081.01(a)(12) |

$290,000 |

|

Compensation of Highly Compensated Employees |

Section 1081.01(d)(3)(E)(iii) |

$130,000 |

|

Cash or Deferred contributions from participants of a retirement plan sponsored by the U.S. Federal Government and participants in a retirement plan qualified under Section 1081.01(d) of the Code and Section 401(k) of the Federal Code |

Section 1081.01(d)(7)(A)(ii) |

$19,500 |

|

Additional contributions from participants in a retirement plan sponsored by the U.S. Federal Government who have reached 50 years of age |

Section 1081.01(d)(7)(C)(v) |

$6,500 |

The applicable limits that do not adopt by reference any limits established by the Federal Code are as follows:

Limit on: |

Code: |

Amount |

|

Cash or Deferred contributions from participants of a qualified retirement plan under section 1081.01(a) of the Code |

Section 1081.01(d)(7)(A)(i) |

$15,000 |

|

Additional contributions from participants of a retirement plan not sponsored by the U.S. Federal Government who have reached 50 years of age |

Section 1081.01(d)(7)(C)(i) |

$1,500 |

|

Voluntary employee after-tax contributions from participants in a qualified retirement plan under Section 1081.01(a) of the Code |

Section 1081.01(a)(15) |

10% of the participant's aggregate compensation for all years they participated in the plan. |

American Opportunity Credit

On December 18, 2015, Federal Law P.L. 114-113 amended the provisions of Section 25A(i) of the Federal Code to permanently extend the benefits of the American Opportunity Credit (the “Credit”). Before this amendment, this credit was available until December 31, 2017.

For the Credit to be applicable to Puerto Rico Eligible Individuals for tax years 2018 and onwards, the Puerto Rico and Federal Departments of Treasury were required to deliver a plan establishing eligibility requirements and parameters for distribution of benefits to Puerto Rico individuals. Said plan was signed on December 14, 2020 and establishes the following requirements and parameters.

Eligible Individuals

- bona fide residents of Puerto Rico during the entire tax year;

- those who filed their return under a Valid Identification Number such as a Social Security number, Individual Taxpayer Identification Number, or any identification number issued by the Internal Revenue Service;

- an individual, nor their spouse, if married filing jointly, can be claimed as a dependent on someone’s else Puerto Rico or Federal return regardless of they were claimed or not by the other taxpayer; and,

- their Adjusted Gross Income (AGI) does not exceed $90,000 or $180,000 if married filing jointly.

If the individual is married but files separately, he/she is no longer eligible to claim the Credit for that tax year.

Eligible Educational Expenses used to calculate the Credit

The Credit is claimed for Eligible Educational Expenses which are costs of tuition, fees, and materials such as books, supplies and equipment among others, specifically required by an Eligible Educational Institution for enrollment or attendance to classes. They must be incurred and paid by or on behalf of an Eligible Student during the taxable year for Academic Periods of a semester, trimester, or any other reasonably determined period, started during the year or within the first three (3) months of the next taxable year.

Eligible Educational Expenses do not include meals, insurance, medical expenses, transportation, and lodging, nor do they include expenses paid due to any class that involves sports, games, or hobbies, unless said class is part of the Eligible Student’s degree program. The eligible expenses will also be reduced by any amount received from exempt reimbursements or any educational assistance, such as scholarships, grants, or awards.

An Eligible Educational Institution can be a college, university, trade school or other public or private post-secondary accredited institution, which is either eligible to participate in student aid programs managed by the U.S. Department of Education or complies with similar requirements established in Section 1088 of Title 20 of the U.S. Code of Laws of August 5, 1997.

An Eligible Student is a student, which is either the taxpayer, their spouse or dependent, that during the tax year in which the Credit is being claimed:

- has not completed their first four (4) years of studies in the Eligible Educational Institution;

- was enrolled and studied for at least half the normal full-time academic load of a degree or certification program of an Eligible Educational Institution during at least one (1) Academic Period beginning on the tax year in which the Credit is claimed;

- has not claimed the Credit nor the Credit was claimed on their behalf for four (4) tax years;

- has not been convicted of a crime due to possession or distribution of controlled substances during the tax year;

- and, has a Valid Identification Number.

Determining the Credit

The maximum amount of the Credit allowed to be claimed by an Eligible Individual is $1,000 and can be calculated as follows:

|

40% |

X |

(100% of the first $2,000 of Eligible Educational Expenses paid during the taxable year + 25% of the next $2,000 of Eligible Educational Expenses paid during the taxable year) |

= |

Credit (maximum of $1,000) |

However, if for the taxable year, the AGI of the Eligible Individual exceeds $80,000 or $160,000 if married filing jointly, the maximum Credit allowed will be proportionally reduced until it reaches $0. Eligible Individuals with an AGI of $90,000 or $180,000 if married filing jointly cannot claim the Credit. The proportional reduction can be calculated as follows:

|

Eligible Individual’s AGI - $80,000 (or $160,000 if married filing jointly) |

= |

% of reduction |

|

$10,000 (or $20,000 if married filing jointly) |

Procedures and forms used to claim the Credit

An Eligible Individual may only claim the credit by completing Schedule B2 and filing it electronically with their Puerto Rico Individual Tax Return within the filing deadline (including extensions). The evidence that must be electronically filed as part of the corresponding Return will be the following:

- either a Form 1098-T “Tuition Statement” or an Official Certification issued by the Eligible Educational Institution in the name of the Eligible Student stating the degree program or certification being completed, the amount of Eligible Expenses paid during the year to the Institution, and any economic assistance or exempt reimbursement received along with detail of such amounts.

- the Certification should include the Institution’s Employer Identification Number, address, telephone, Official Seal or letterhead, name and signature of the Dean or Authorized Official, and the Student’s Identification Number.

- copy of a Certificate of Good Conduct issued within 3 months by the Puerto Rico Police.

- if claiming Eligible Educational Expenses for materials, (including supplies books), a schedule that breaks down all expenses which includes date of purchase, vendor name, item description, and total amount paid must be included. Such schedule must be accompanied by copies of receipts and copy of the syllabus evidencing the materials required to attend the class.

For tax years 2018 and 2019, the Credit can only be claimed by electronically filing the 2020 Individual Income Tax Return, Form 482.0 through:

- Schedule B2.1 – American Opportunity Credit for Tax Year 2018

- Schedule B2.2 – American Opportunity Credit for Tax Year 2019

The Credit cannot be claimed through amendments of the 2018 or 2019 Individual Income Tax Returns, and any amount due does not generate interest in favor of the taxpayer. If the Credit is claimed for a tax year by providing incorrect or fraudulent information, the Department will assess and collect the amount erroneously granted, including any applicable interest, surcharges, and penalties. Additionally, the taxpayer will not be able to claim the credit again for any Eligible Student for a period of ten (10) years if it is determined that the Credit was erroneously claimed due to fraud; or for a period of two (2) years if the Credit was erroneously claimed due to reckless or willful neglect of rules and regulations.

Finally, the amount received for this Credit is excluded from gross income for income tax and alternate basic tax purposes.